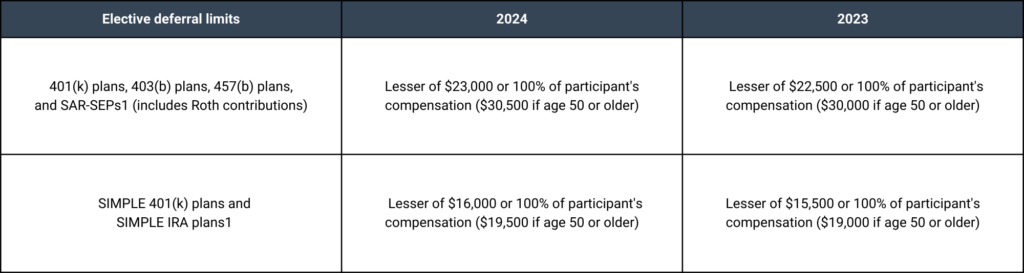

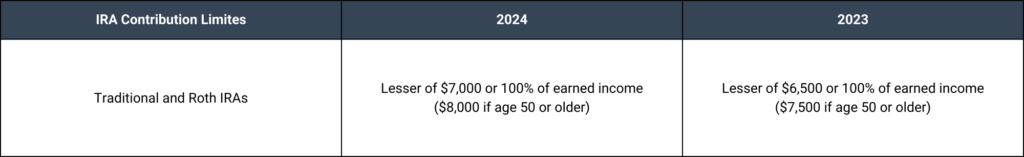

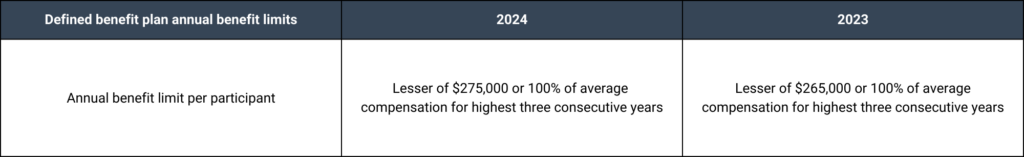

Keeping up to date on the latest information regarding retirement is part of what we do. Below outlines the 2024 retirement limits and what they mean for your retirement planning.

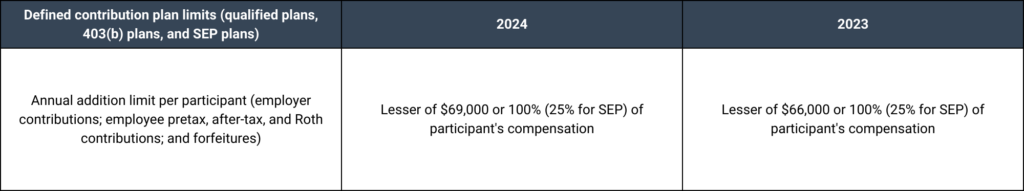

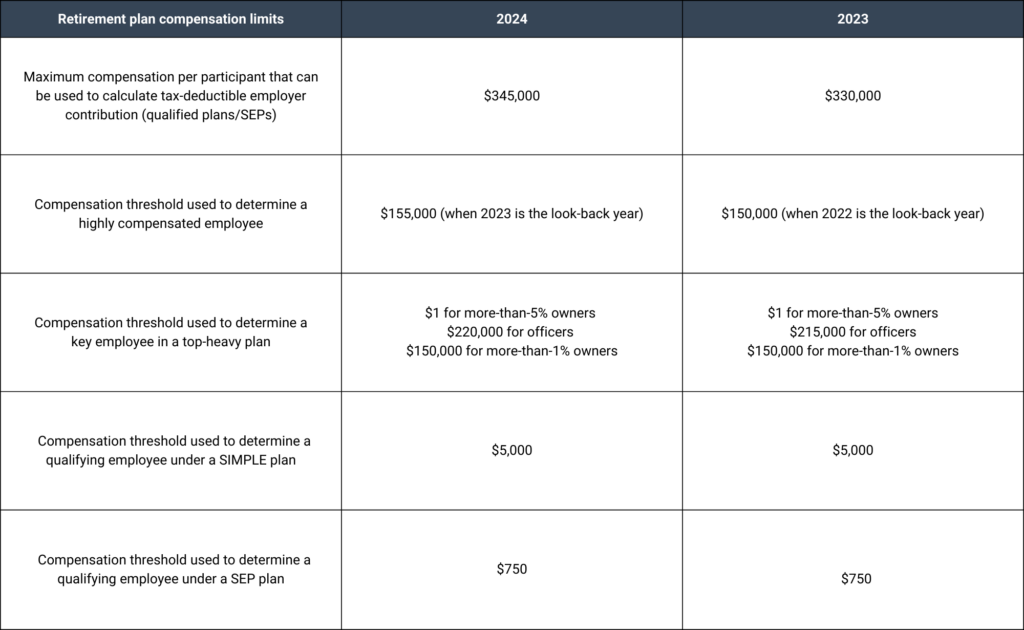

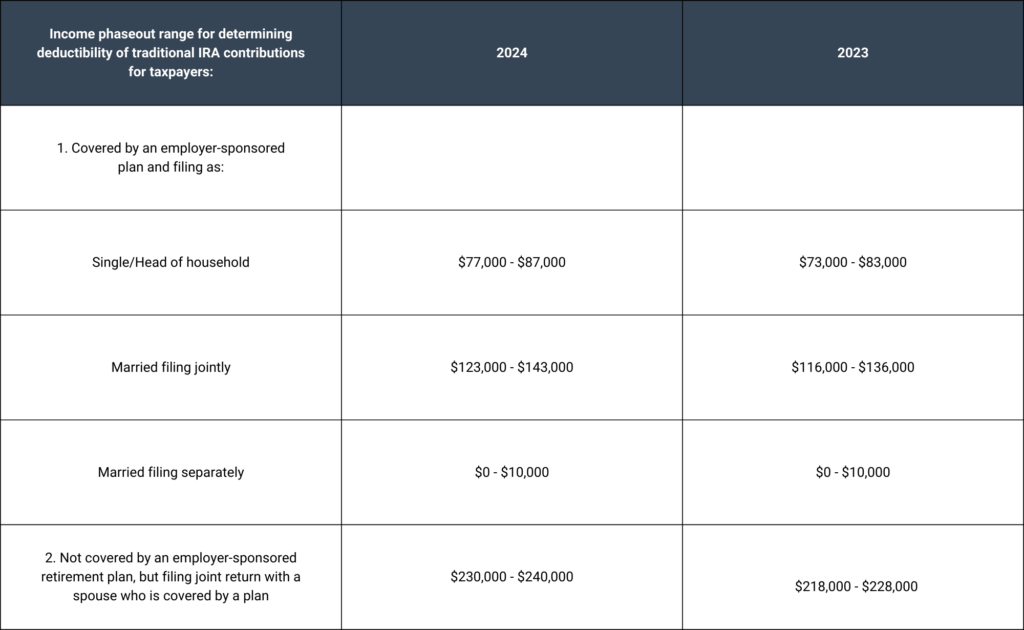

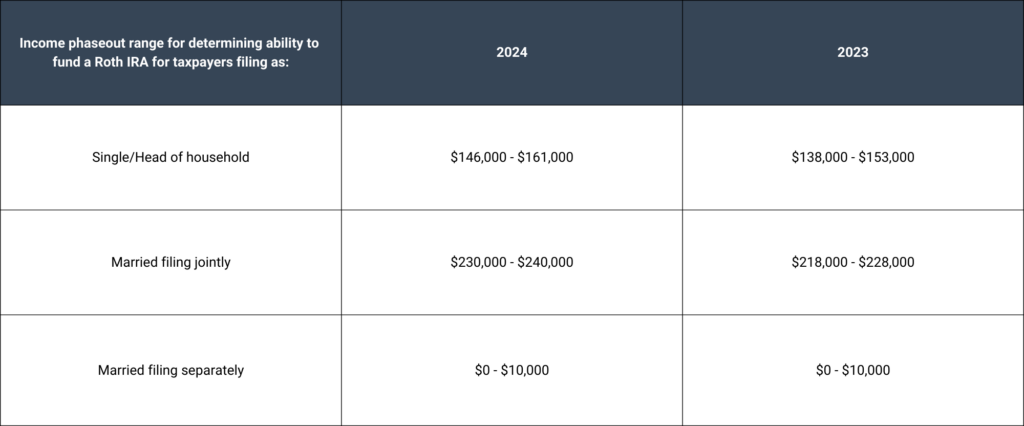

Retirement limits refer to the maximum amount of contributions that can be made toward various types of retirement accounts. Certain retirement plans and IRA limits are indexed for inflation each year, but only some of the limits eligible for a cost-of-living adjustment (COLA) have increased for 2024. Some of the key numbers for 2024 are listed below, with the corresponding limit for 2023. (The source for these 2024 numbers is IRS Notice 2023-75.)

If you have questions about these limits, we would happily help you determine what’s right for your situation.

1 Must aggregate employee deferrals to all 401(k), 403(b), SAR-SEP, and SIMPLE plans of all employers; 457(b) contributions are not aggregated. For SAR-SEPs, the percentage limit is 25% of compensation reduced by elective deferrals (effectively a 20% maximum contribution).

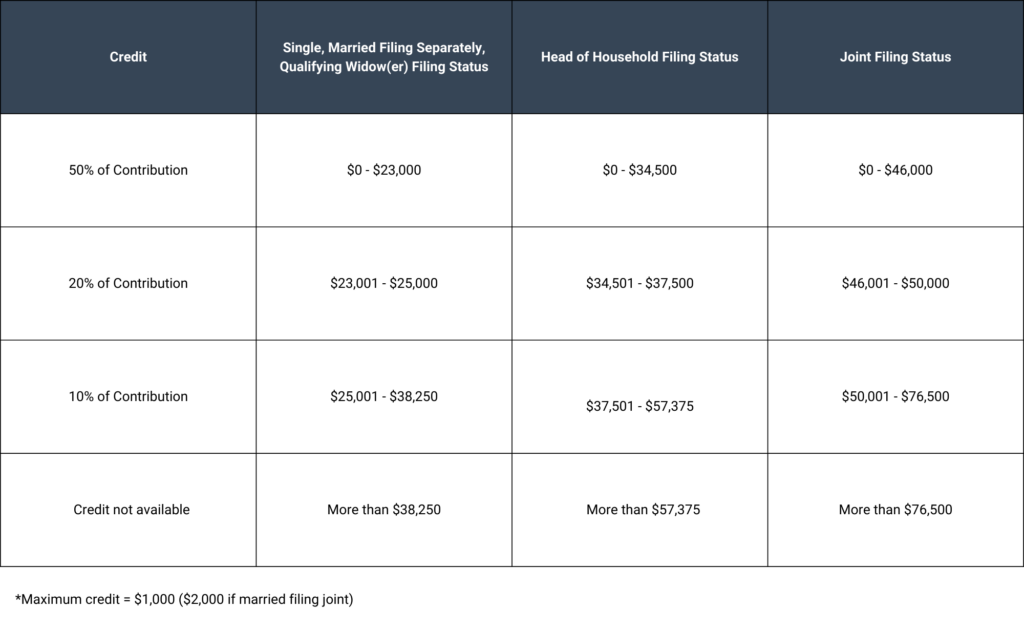

Saver’s Credit* for Different Income Levels

Adjusted Gross Income