Charitable Gift Annuities (CGAs) are a form of planned giving that enables donors to support colleges and universities while securing a fixed income stream for their lifetime. These arrangements can be mutually beneficial: institutions like Westminster College receive immediate funding, and donors can enjoy financial and tax advantages.

What Is a Charitable Gift Annuity?

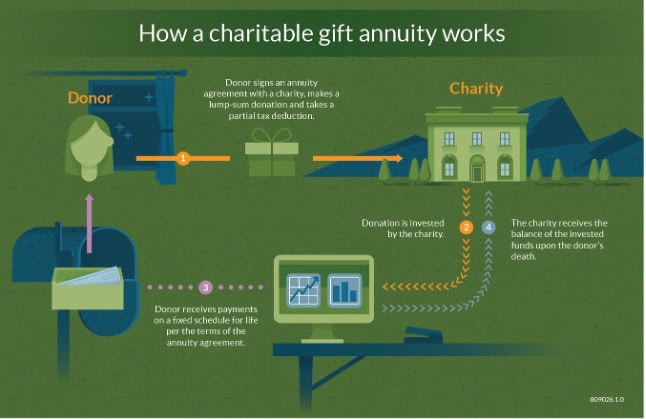

A CGA is a contract between a donor and a nonprofit organization, such as a college, where the donor transfers assets—typically cash, securities, or appreciated property—in exchange for a fixed annual income for life. Upon the donor’s death, the remaining principal supports the institution’s mission. State laws govern the arrangement, and the charity is responsible for ensuring it has sufficient reserves to meet its obligations.

Pros of Charitable Gift Annuities for Colleges

- Steady Income Stream

Donors receive predictable, fixed payments for life. This can be particularly appealing for retirees seeking stable income.

- Immediate Tax Benefits

Donors are eligible for an income tax charitable deduction in the year the gift is made. The deduction amount depends on factors such as the donor’s age and the value of the gift. Additionally, a portion of the annuity payments may be tax-free, enhancing the gift’s value.

- Capital Gains Tax Relief

When appreciated assets are donated, donors can avoid paying capital gains taxes on the appreciation of those assets. Instead, any capital gain is reported over time as part of the annuity payments, potentially reducing an immediate tax burden.

- Support for Educational Institutions

Colleges benefit from immediate funding, which can be used to support scholarships, faculty positions, or campus improvements. Institutions like Westminster College offer CGA as part of their planned giving programs.

“A gift annuity agreement is a lifelong contract, not a trust, between Westminster College and an individual or couple, who are referred to as annuitant(s). The terms of this agreement will lock in the rate, amount, and timing of all payments the annuitant(s) receive.”

Other Considerations of Charitable Gift Annuities

Before deciding to use a CGA, consider your circumstances to ensure it aligns with your desired planning. Once the gift is made, it cannot be undone – it is irrevocable. Donors relinquish control over the donated assets, which may not be suitable for those who anticipate needing access to the funds in the future. Additionally, the fixed nature of CGA payments means they do not adjust for inflation. Over time, this can erode the purchasing power of the income received.

If you have the desire to donate to multiple organizations, an alternative Charitable Remainder Trust may be a better choice. It is essential to recognize that Charitable Remainder Trusts can be more complex to establish and manage, often requiring the assistance of legal and accounting professionals. Ongoing administrative costs can include trustee fees and preparation of tax filings, which may be higher than those associated with CGAs.

When deciding on how best to move forward, donors should carefully consider their financial goals, asset types, and desired level of control beforehand. It is important to have personalized guidance to ensure the chosen vehicle for gifting aligns with the donor’s philanthropic and financial objectives. Consulting with a tax advisor is crucial to understanding the full tax implications, including deductions and the taxability of annuity payments.