Investors who want to time the market face a peculiar challenge. Market timing is not about making just one correct call; you need to make two perfectly precise decisions.

- First, you must decide when to sell, identifying the exact peak or a significant downturn before it happens.

- Next, you must decide exactly when to buy back in, recognizing the absolute bottom or the start of a sustained upward trend.

From a statistical standpoint, this is like calling a coin flip correctly, twice in a row. Most of us know that the odds of getting either “heads” or “tails” on a given coin flip are 50%; the result has to be one or the other. But what are the odds of correctly calling “heads” or “tails” twice in a row? Statistically, the odds of getting either result twice in a row are 25%. Let’s say that making a correct market timing call is “heads,” and getting it wrong is “tails.” Would you be willing to bet potentially thousands of dollars in portfolio gains or losses on a 25% chance of calling “heads” twice in a row?

Other Considerations

Independent events. And there are even more factors to consider. For example, independent events can also trigger unexpected market movements. So, while the market isn’t as simple as a coin flip, each decision to get in or out is an attempt to predict the future. The probability of being precisely correct on one is already low; being correct on two independent events multiplies those low probabilities together, resulting in an even smaller chance of success.

Human Emotion. Market timing decisions can be strongly influenced by emotion. Fear often drives selling during downturns, and greed can lead to buying at inflated prices. These emotional responses rarely align with rational, well-timed decisions.

Transaction Costs and Taxes. Even if someone were able to time the market occasionally, the repeated buying and selling would incur transaction costs (brokerage fees) and potentially trigger taxable events (wash sales), further eroding any potential gains.

Long-Term Investing

By contrast, a disciplined, long-term investing strategy can be a more reliable strategy. It differs from the market-timing approach in several respects.

Capturing Compounding. Over long periods of time, returns on investments can compound significantly. Missing even short periods of high growth due to mistimed exits can have a substantial negative impact on overall returns.

Averaging Out Volatility. Market volatility is a normal part of investing. Over the long term, the market ups and downs tend to average out, and the overall trend of the market has historically been upward. Trying to avoid the “downs” also means potentially missing the “ups.”

Focus on Fundamentals. Long-term investing emphasizes understanding the underlying value of investments (companies, assets) and holding them through market cycles.

Less Emotional Decision-Making. A long-term perspective reduces the urge to make impulsive decisions based on short-term market fluctuations.

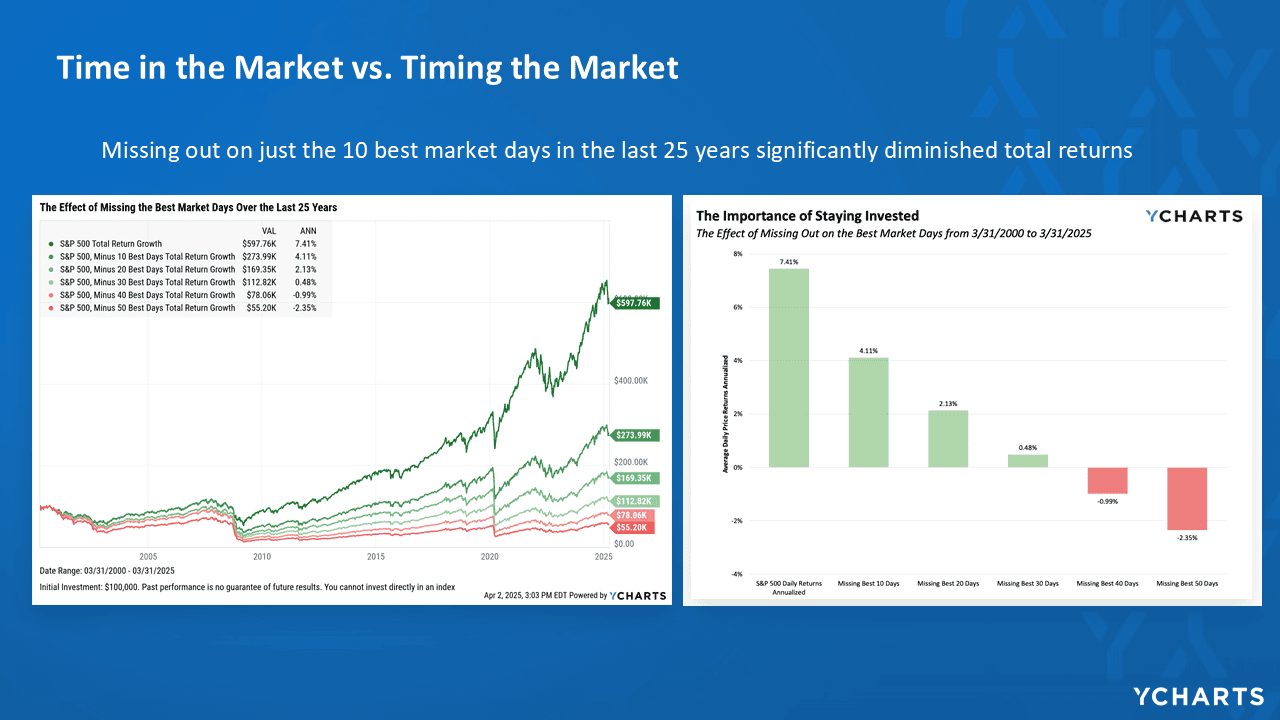

Comparing Time in the Market vs. Timing the Market

SOURCE: Y Charts. Past performance does not guarantee future results; indexes are not available for direct investment.

The chart above illustrates the financial impact of getting “tails” instead of “heads” in attempts to time the market. The line graph on the left indicates that by missing just the best 10 days of market gains over the past 25 years, an investor with an initial $100,000 investment would end up with about $274,000, compared to the nearly $600,000 they would have had by simply staying invested and riding out the ups and downs. Similarly, the chart on the right shows that by missing out on these 10 days of market advances, the investor’s total return over 25 years would be just over 4%, compared with the more than 7% that could have been achieved by remaining in the market.

In conclusion, the odds of consistently and successfully timing the market are indeed slim to none. It requires not just one lucky guess, but two precise and often emotionally challenging decisions. For most investors, focusing on a well-diversified portfolio and a long-term investment horizon tied to financial goals is a far more reliable and less stressful path to achieving their financial goals. Time in the market, rather than timing the market, has historically proven to be the more effective strategy.

If you have questions about current market conditions, investing strategies, or other important financial matters, please reach out to your JFS advisor today. And to learn more, please visit our website and read our article, “Staying the Course: Long-Term Investing through Volatile Markets.”