“How much is that doggie in the window,” you ask. Well, part of the answer depends on whether or not the doggie is insured. For more and more Americans, pet insurance is one way to prevent an emergency visit to the vet from chewing an unsightly hole in the household budget.

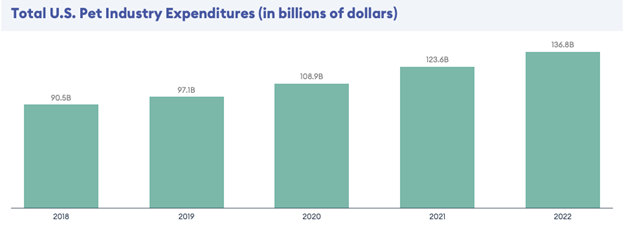

All punning aside, pet health insurance is trending, and with good reason. In 2022, Americans spent nearly $137 billion on their household pets, according to a survey by the American Pet Products Association. Over the past thirty or so years, pet ownership in the US has gone up significantly, with 66% of US households claiming pets as members—up from 56% in 1988. And an almost unanimous 97% of American pet owners say their pets are vital members of the family; 51% say they are just as important as the humans in the household.

According to a report in Forbes Advisor, households with annual incomes of $100,000 or more are the most likely to own pets; 63% of these families’ “fur babies” are dogs, and 40% of them own cats (dogs and cats are the runaway favorites, with dogs accounting for 65.1 million households and cats in 46.5 million homes). Dog owners spend an average $1,533 annually on essential expenses, and those who require “doggy day care” can expect that amount to be more like $3,000 annually. The two biggest expense categories for cat owners are food (average $310 annually) and veterinary care ($253 annually). The trend for pet expenditures is clearly on the upswing.

SOURCE: American Pet Products Association, courtesy Forbes Advisor

Pet Insurance Facts

Given the steadily rising costs associated with owning a pet, how does pet insurance factor into the picture? Is it worth it? After all, the product didn’t even really exist until 1982. Is it worth the time and—most important—the expense?

Probably the thing pet owners worry about most is an emergency visit to the vet. These can easily run between $800 and $1,500, and that matters, because 63% of pet owners say they would have difficulty paying a surprise vet bill in the current inflationary economy. About 42% say a bill of $999 or more would force them to incur credit card debt. And yet, nearly three-quarters of pet owners say they do not have pet insurance.

However, most pet owners overestimate the cost of pet insurance. In fact, premiums can be surprisingly low. Just as with insurance for humans, the cost of pet insurance varies by region and also by the age and species of the pet. For example, the average cost of insuring a dog against accidents and illnesses is about $640 per year; for cats, the same coverage runs about $387 (sorry, dog people!). To cover accidents only, the cost is less: about $201 for dogs and $122 for cats. Of course, just as with insurance for humans, rates rise as the animal ages and becomes more susceptible to health problems. So, if you keep the policy in force over the entire lifespan of your pet, you could be paying upwards of $1,000 in annual premiums by the time your dog or cat reaches 10 years or more in age.

What kind of coverage do you get for the money? Again, policies tend to vary by region and species, but generally, your policy will require you to satisfy a deductible, and after that, it will pay a percentage of vet bills that can range from 70% to 90%. As with other insurance, the lower your deductible and the higher the payout percentage, the more the monthly premiums will be.

Obviously, it’s really important to read and understand your policy, especially with regard to excluded expenses. For example, most pet policies don’t cover spaying or neutering, unless you pay extra for add-on coverage. Ditto for annual checkups, teeth cleaning, and vaccinations. Pre-existing conditions are probably the most important exclusion. In other words, if your cat is already diagnosed with cancer, don’t try to purchase a policy with the expectation that the chemotherapy will be a covered expense.

Weighing Options

Looking at all this, some may conclude that owning a policy is good way to “put a leash” on surprise vet expenses. On the other hand, some may conclude that a better choice would be to simply deposit the amount of a monthly premium into a liquid account—perhaps high-yield savings—establishing a sort of “private cafeteria plan” earmarked for non-routine veterinary costs. With this alternative, the funds are available for other uses if they aren’t needed for vet bills. Breaking down the decision even further, you might consider pet insurance to be a viable option if:

- Your pet is relatively young and healthy;

- You lack sufficient savings to cover an unexpected cost of $1,000 or more;

- You prefer shifting a portion of the liability onto an insurance company.

On the other hand, pet insurance may make less sense if:

- Your pet is older or otherwise in poor health;

- You have the resources to cover a vet bill of $1,000 or more;

- You prefer retaining liquidity over paying for something you might never need.

As with most decisions, it helps to have all the facts and to consider your individual situation and resources. At JFS Wealth Advisors, our service is predicated on giving our clients the information they need in order to arrive at decisions that are in their best interests. To learn more about our fiduciary planning services for families and individuals, please visit our website.