Thousands of years ago, a wise person advised, “Do not muzzle the ox that treads the grain.” Though this agrarian proverb may sound quaint to modern ears, the message is timeless: It is vital to take care of those who are responsible for guaranteeing the wellbeing of your enterprise.

This is nowhere truer than for those on the leadership team of your business —your “C suite.” Executive compensation packages are clearly not a one-size-fits-all consideration. Instead, the compensation packages for your company’s strategic leaders must reflect the values of your organization, its strategic priorities, and its most important desired outcomes. It is a well-known management principle that you can’t improve what you can’t measure, and it is equally true that your executive team’s leadership focus and effectiveness are directly impacted by how their compensation is structured.

According to the Harvard Business Review (HBR), one of the most important principles in designing compensation packages for your C-suite is, to begin with, the end in mind. “When compensation is managed carefully, it aligns people’s behavior with the company’s strategy and generates better performance,” they write. “When it’s managed poorly, the effects can be devastating: the loss of key talent, demotivation, misaligned objectives, and poor shareholder returns.” In other words, executive compensation design must start with a clear understanding of what is most vital for the success of the enterprise and what is required for its leaders to accomplish these key objectives.

Fortunately, this doesn’t mean you have to reinvent the wheel. Publicly traded companies are required to report the amount and type of compensation provided to leadership positions like the CEO and CFO, along with the criteria by which various aspects of compensation are awarded. In other words, there is plentiful data available to use in deciding about the right mix of various types of compensation for your C-suite personnel.

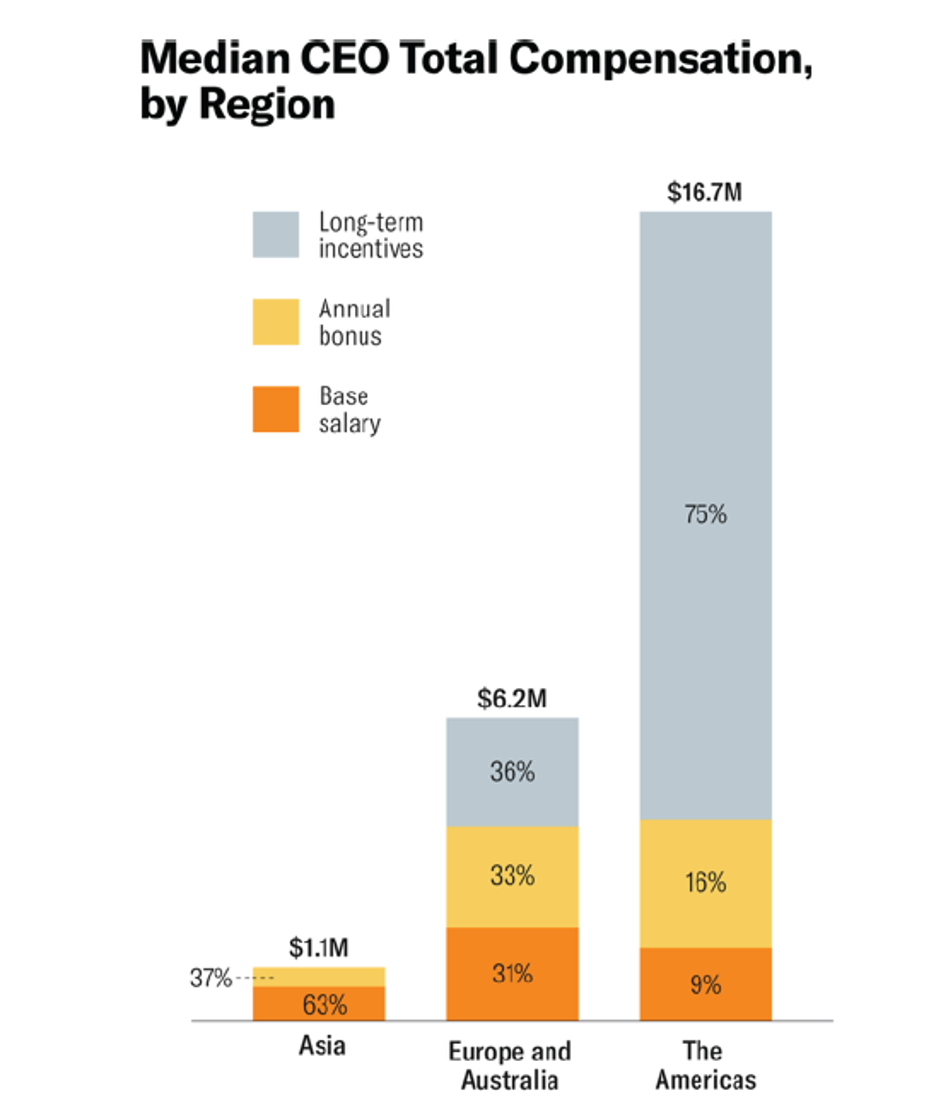

One way of categorizing executive compensation is according to its time horizon: short-, medium-, or long-term. Perhaps predictably, the preponderance of CEO compensation in the United States and the rest of the Americas is structured as long-term.

SOURCE: Harvard Business Review, from 2018 Global Top 250 Compensation Survey (F.W. Cook, FIT Remuneration Consultants, and Pretium Partners Asia, Limited)

As noted by human resources consulting firm Eddy, four main dimensions of executive compensation packages drive performance:

- Fixed vs. variable. A specified salary amount is an example of a fixed element. Variable elements might include incentives based on company performance.

- Short- vs. long-term. Short-term elements might include quarterly or monthly performance-based goals, while long-term elements might typically be assessed over a period of three years or more.

- Cash vs. equity. Many executive compensation packages offer some combination of cash (often in the form of salary) and equity, or a share of ownership in the company such as stock options or other similar incentives.

- Individual vs. group. Here the package may be designed to balance rewards between individual performance and the ability of leaders to improve collective performance of a group or groups within the enterprise.

A well-designed compensation package balances these four dimensions in a way that creates alignment with company strategy, priorities, and long-term goals.

The Society for Human Resource Management further divides executive compensation into the following categories:

- Direct compensation—annualized pay before incentives;

- Annual incentives or bonuses—typically, pay-for-performance plans;

- Long-term incentives—measured over a period of three or more years to incentivize retention;

- Stock plans—to create ownership interest;

- Perks, benefits, and plans—can include company vehicles, technology resources, access to clubs and company memberships, and other elements;

- Retirement plans—enhanced contributions to 401Ks or other retirement plans;

- Deferred compensation—offering highly compensated executives deferral of tax liability until retirement.

Finally, a properly designed executive compensation package should consider the following attributes of the enterprise:

- Life cycle stage of the organization (startup, growth phase, mature business, etc.)

- Industry type

- Structure (for-profit or non-profit; publicly traded or privately owned, etc.)

- Regulatory requirements.

At JFS Wealth Advisors, we understand that your business requires planning, guidance, and strategy that is built around your unique needs and goals. To learn more about how we work with business owners to optimize defined benefit plans, deferred compensation, exit planning, and other vital strategic components, click here.