The notion that owning gold is an investor’s last and best safe haven is deeply embedded in the worldwide psyche. Think about it: all our lives, when anyone wants to describe something with a value, quality, or effectiveness that is beyond question, we’ve heard them use phrases like, “solid gold,” “good as gold,” “the gold standard,” or something similar. What’s the medal for first place? Gold. What do you find at the end of the rainbow? A pot of gold. For that matter, what made the king of Spain the western world’s wealthiest and most powerful man during the sixteenth century? Gold, mined from the North and South American colonies and transported to the royal treasury in Madrid.

So, it makes sense that, particularly during periods of uncertainty in the financial markets (and when has there not been some degree of uncertainty in the financial markets?), it seems that every other commercial you see on the financial networks is promoting the benefits of owning gold. Traditionally, gold has been touted as both an inflation hedge and a secure place to store value when other asset types are exhibiting subpar performance.

But is gold really the best asset to use for such purposes? It’s true that gold was up 25% year-to-date, as of April 30, likely in large part because of the market anxiety surrounding the tariff announcements coming from the White House. Given that and similar examples, it’s easy to see why investors would believe that gold is the ultimate safe haven when things are looking shaky.

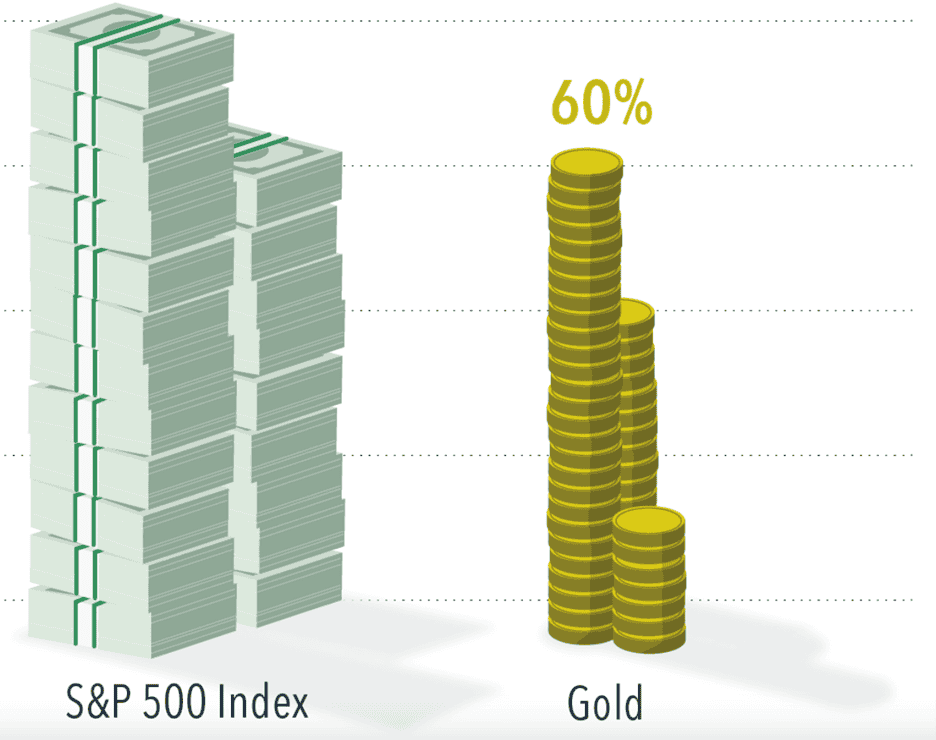

The problem with this belief is that it may not be borne out by actual historical performance. As a matter of fact, the market value of gold has been far from immune to drawdowns. Since 1970 (the year before President Nixon officially abandoned the gold standard for US currency), gold has been positive in just 60% of calendar years, while the S&P 500 Index has been positive in 80%. Investors hoping for a safe haven may not find it with gold.

Source: Dimensional Fund Advisors. Past performance is no guarantee of future results; indexes are not available for direct investment.

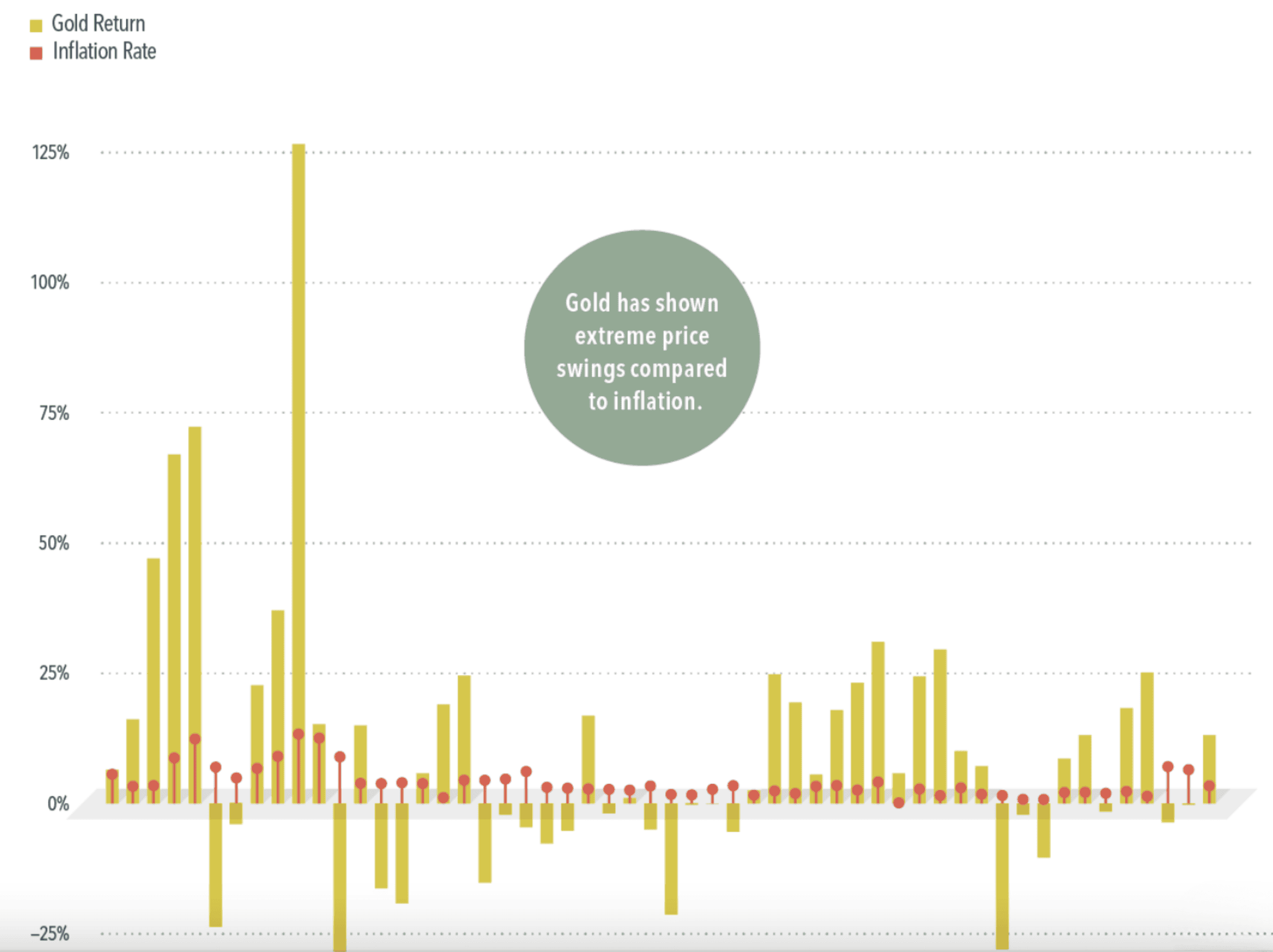

But what about inflation? Surely, when the demand for goods and services is outstripping supply and prices are skyrocketing, gold, as a durable, tangible asset, would be the most dependable place to preserve value, right?

Maybe not. Going back to 1970 again, data indicate that gold has often experienced large price swings relative to annual inflation.

SOURCE: Dimensional Fund Advisors. Past performance is no guarantee of future results.

As the chart demonstrates, the price of gold has often swung wildly outside any mechanism justified by the rate of inflation—more often being much more expensive than inflation would indicate. So, while preserving value during periods of rising consumer prices is certainly a valid objective for investors, gold may not be the most cost-effective tool for the job. In fact, US Treasury inflation-protected securities (TIPS), with prices adjusted in direct proportion to inflation, could be much more reliable and cost-effective, not to mention that TIPS can be held and traded in a brokerage account, which is typically easier than taking direct delivery of physical gold.

So, what’s the answer for investors? Is gold bad? Certainly not. Owning gold can be a valuable part of a financial strategy. But the operative word is “part”; gold is usually best understood as one component among several for investors who want to hedge their portfolios against inflation and market volatility. The most important thing for investors is to understand how market risk impacts the various asset types in their portfolio and to have a portfolio designed to operate within the risk parameters that match the investor’s goals, stage in the investment life cycle, and ability to tolerate risk. As the above information shows, even gold comes with risks, like any market-driven asset. What matters most is understanding that risk in the context of the investor’s overall resources and objectives.

At JFS Wealth Advisors, our most important task is to work with clients to gain a thorough understanding of their risk tolerance, investment objectives, and most important values. In this way, we can help them construct diversified portfolios that are designed to capture available value within acceptable risk parameters. Investors who employ evidence-based financial strategies and maintain commitment to those strategies through various market cycles are often able to achieve their most important long-term goals.

To learn more, please visit our website and read our recent article, “How Big, How Beautiful? The Trump Budget Bill and Your Finances.”