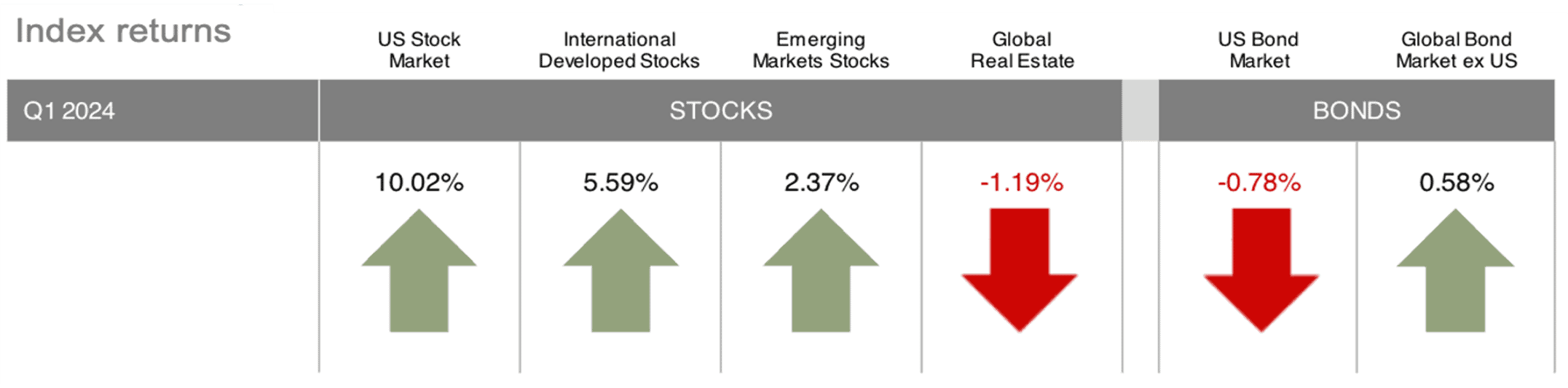

The first quarter of 2024 saw continued strength in global stock markets. Broad U.S. stocks as measured by the Russell 3000 index gained 10%, the S&P 500 climbed 10.2%, and small US companies as measured by the Russell 2000 gained 4.8%. International developed markets rose 5.6%, and emerging markets climbed 2.4%. Following a strong end to 2023, bond prices stagnated, with the Bloomberg Barclays Aggregate declining by 0.8%.

US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net div.]), Emerging Markets (MSCI Emerging Markets Index [net div.]), Global Real Estate (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg Barclays US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Barclays Global Aggregate ex-USD Bond Index [hedged to USD])

In December 2023, we wrote about the Federal Reserve “pivot” toward an end of rate hikes and excited anticipation in the financial markets about coming rate cuts. We also sounded a note of caution, stating, “You may want to keep the champagne chilling a bit longer.” This seems prescient now, as recent inflation reports have been – while still improving year over year – offering a mixed picture, reflecting still-stubborn pricing pressures on goods and services. At the same time, labor markets have continued solid job growth. This has led, as reflected by bond prices, to forecasters shifting views, now looking for fewer U.S. rate cuts in 2024 than initially expected. Indeed, the path of interest rates in the face of surprising economic strength in the U.S. remains the main story line when it comes to stocks and bonds.

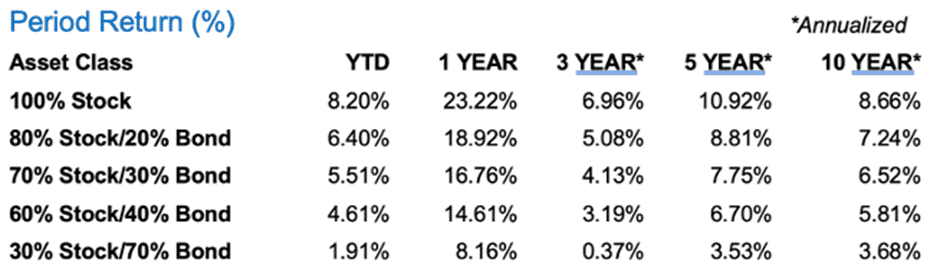

Indices used for hypothetical portfolios returns are the MSCI ACWI for equities and the BBgBarc US Agg Bond for fixed income. All data derived from Morningstar Office. Past performance is no guarantee of future returns.

So, let’s begin there. Today’s Fed Funds target of 5.25% – 5.50% is the highest in 23 years. Commencing in March of 2022, as effects from the pandemic began to fade, the Fed embarked on a steady series of hikes to rein in rising inflation and counter a booming job market as the world “re-opened” post-pandemic. The elusive goal of a central bank rate hiking cycle is the so-called “soft landing”: i.e., slowing the pace of inflation and labor market growth to stable levels without causing a recession. It is a delicate balancing act performed with incomplete information and a time lag between institution of higher rates and their effects on the economy. In their last meeting, the FOMC held the rate steady, noting they are closely watching inflation movement and labor market direction. While the “soft” landing is not yet in the books, and there is still turbulence in the air, thus far the Fed seems to be on the correct glide path. Inflation is down substantially from its 9.1% high and jobs growth remains buoyant. As noted above, the consensus forecast looks for the Fed to begin lowering rates sometime later in 2024 – although no one can be certain.

Signals from the U.S. economy in the first quarter were mixed; not surprising, given a global landscape in turmoil. Leading economic indicators declined by 2.6% over the past 6 months but showed a slight increase in the February reading (March is not yet released). And while the ISM Manufacturing Index registered a surprise gain in March, its sister Services Index slowed and came in well below forecast.

Looking at other measures of economic growth, overall U.S. Gross Domestic Product (GDP) remains positive. Fourth quarter GDP was recently revised upwards to a 3.4% annual rate, and most analysts are calling for 2024 annual growth in the range of 2% or higher: in other words, slowing, but still solidly positive.

One of the economic signals that has not been mixed is employment. 303,000 new jobs were created in March, far surpassing estimates. Unemployment eased to 3.8%, and wage growth came in at 4.1% year-over-year. This means that wage growth has exceeded inflation, putting real money in consumers’ pockets. There are now about 8.8 million job openings and 6.6 million unemployed: a ratio of 0.7 unemployed per opening. Contrast that with the pandemic high of 23 million unemployed and a ratio of 5.0 per opening. The labor improvement is impressive and unambiguous. Economists note that much of that strength comes from immigration, as non-U.S. workers fill lower-paying jobs. Border chaos is a flash point in a charged election year, but immigration has clearly benefited labor markets.

Turning to inflation, while the broad trend has been unambiguously lower, recent data has been “noisy,” leading to lowered confidence in both the timing and magnitude of forecasted rate cuts. For example, February’s CPI rose by 0.4% in the month, ahead of forecasts, and sits at 3.2% year-over-year, up from 3.1% year-over-year in January. And, the Price Consumption Expenditures (PCE), which measures actual changes in prices paid for goods and services and is the preferred index for the Fed, rose 0.3% in February, up 2.5% year-over-year, a slight increase from January. In other words, the easing of price pressures is not happening in a straight line. To be sure, Fed Chair Jerome Powell has noted that they expect “the last mile” back to a 2% target to occur in fits and starts, and at least so far, he has signaled that the Fed remains on course with likely rate cuts in 2024. But the “bumpiness” of the data is enough to send jitters through both stock and bond markets with each new release. The recent bridge tragedy in Baltimore has raised additional concerns that a goods blockage will negatively impact inflation. While Baltimore is indeed the leading port for auto imports, there are alternatives and workarounds, and it seems likely any impact will be minor.

The U.S. economy is driven by consumer spending, and on that front the picture is similarly turning murky. While spending has been strong—up 0.8% in February—anecdotal data from credit cards to auto loans to mortgages suggest the U.S. consumer may be nearing a stress point. Bad debt write-offs by banks are climbing, and credit card balances are near highs. So, while consumer sentiment has climbed 30% from March of 2023 to today, household finances may be tightening, and coupled with a sour national mood of divisive politics, overall spending is facing headwinds. The Conference Board, which provides the widely followed Consumer Confidence Index, noted recently, “The Conference Board expects annualized U.S. GDP growth to slow over the Q2 to Q3 2024 period, as rising consumer debt and elevated interest rates weigh on consumer spending.”

As noted in the first paragraph, equity markets, particularly in the U.S., have been strong. A tailwind of bullish rate forecasts, artificial intelligence euphoria, as well as improved profit margins, increased share buybacks, and rising dividends have led to price gains. Share buyback announcements so far in 2024 are the highest in the past eight years. Yet concentration in the top market names, at the highest in over 40 years, remains a concern. Cryptocurrencies have roared back into headlines, as have meme stocks and their highly volatile ups and downs, often totally disconnected from any real rationale, leading some commentators to raise alarms. The “bubble” word is appearing in market commentaries again. Add in sharply rising tensions in the Middle East, worries over China’s Taiwan ambitions, and the ongoing Russian aggression in Ukraine, and it is clear that the “Peace Dividend” era ended decisively in 2022, making the world a far scarier place and a less certain one in which to invest.

With such a backdrop, diversification remains a prudent and time-tested way to avoid concentration risk. While U.S. stock markets have continued to outperform those outside our borders, foreign markets comprise approximately 40% of the global stock market, meaning that a large opportunity set is ignored with a U.S.-only focus. In addition, from a GDP perspective, it may surprise you to know that when adjusting purchasing power to parity, U.S. GDP is just above 15% of the world total. And in the Eurozone, inflation has eased more decisively, leading to the likelihood of rate cuts sooner rather than later by the European Central Bank. Thus, looking abroad—carefully and with a limited target range—makes sound investment sense for the long-term.

For the quarter, yield on the 10-year treasury rose by 34 points, ending the quarter at 4.20%. In the face of Israel/Hamas hostilities and a rising worry of Iranian involvement, crude oil prices rose by 16.49%, ending the quarter at $83.06. The price of gold climbed 8.31%, reflecting both a weakening dollar as well as traditional safe-haven status in times of uncertainty, ending the quarter at $2,244.70.

A final note regarding cash. With interest rates at multi-decade highs, cash, in the form of money markets and/or CDs, is providing an annualized return near 5%. It is a siren call for many, and indeed is attractive if cash is needed for short-term (within a year or so) expenses. But from an investment perspective, historical data is clear that high quality bonds will significantly outperform cash in the years following the final rate hike. A recent study by Hartford Funds details that since 1983, the broad Barclays U.S Aggregate Index has outperformed cash by 17% in the three years following the final rate hike of a cycle. This is a significant penalty to pay for feeling good in cash and ignoring the facts. Currently the last rate hike of this cycle was in July of 2023, and while our crystal ball is not perfect, it seems likely we are on track for improved bond returns. Remember that cash yields will fall once the Fed is finished, and it’s perhaps a canary in the coal mine that Goldman Sachs recently reduced what their high yield accounts are paying. So even with a strong economy possibly pushing out the date when the Fed will cut, bonds are a better choice than cash for longer-term portfolios. Speak to your advisory team about finding your particular “sweet spot” between cash needed for expenses and budget security, and bonds held for investing. It makes a difference!

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JFS Wealth Advisors, LLC [“JFS]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from JFS. JFS is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the JFS’ current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.jfswa.com. Please Remember: If you are a JFS client, please contact JFS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.