Navigating Global Uncertainty: Resilience and Opportunity Amid Rising Risks

As we write this commentary, hostilities across multiple fronts in the Middle East continue to increase following Iran’s second major missile attack on Israel, and oil prices have jumped, reminding us that risk and volatility are an ever-present unknown in the investing landscape. Domestically, much of the Southeast is facing tragedy and severe hardship from Hurricane Helene, while yet another storm is bearing down on Florida and a much-feared dock workers strike thankfully ended shortly after beginning. Oh, and let’s not forget that in just a short month we will go the polls in a polarizing November election. For all these reasons, looking ahead to the 4th quarter is a challenging task. But for now, whether reviewing the past three months or noting the current economic conditions, indicators and data are mostly positive.

Last quarter we wrote of a “Goldilocks” market environment – benign inflation, interest rates primed to decrease, and steady economic growth. The third quarter certainly fit that bill, and the Federal Reserve on September 18 aided that narrative by delivering its first rate cut since March 2020. In response, financial markets advanced. Broad US stocks as measured by the Russell 3000 index gained 6.2% and the S&P 500 climbed 5.5%. Declining rates boosted small companies, with the Russell 2000 rising 9.3%. International developed markets rose 7.8% and emerging markets climbed 8.7% as China has rolled out aggressive stimulus measures. Bond prices continued their strength in the face of declining inflation and now, actual rate cuts, with the Bloomberg Barclays Aggregate rising 5.2%. Yields on the 10-year Treasury declined over the quarter, ending at 3.8%. Crude prices declined (but have since climbed again), ending at $68.35, while gold put in another strong showing, gaining 13.7% and ending the quarter at $2,654.60.

US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net div.]), Emerging Markets (MSCI Emerging Markets Index [net div.]), Global Real Estate (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg Barclays US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Barclays Global Aggregate ex-USD Bond Index [hedged to USD])

Forecasting the financial markets is at best an inaccurate science, and indeed, many like to point out the folly of making market bets based on such information. Today, with all the global and domestic uncertainty, it seems perhaps even more difficult than usual. Much ink has been spilled writing about the next shoe to drop that would derail economies and markets, but that has yet to occur. So, for now, there are things we do know, and much hard data to frame the picture of a still solid and resilient US economy that has led to repeated records for stock prices. Let’s take a look.

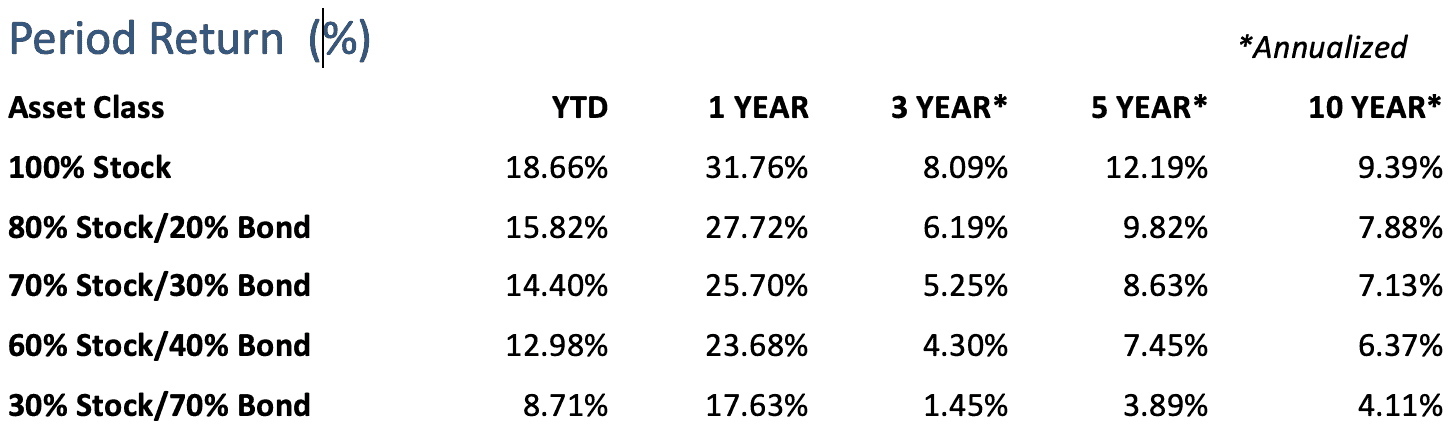

Indices used for hypothetical portfolios returns are the MSCI ACWI for equities and the BBgBarc US Agg Bond for fixed income. All data derived from Morningstar Office. Past performance is no guarantee of future returns.

Inflation has been at the forefront of much of the past market angst, but now is helping lead market enthusiasm. The most recent inflation data clearly show declining price pressures. For consumers, August CPI increased 0.2%, and has gained 2.5% in the past 12 months, the smallest annual gain since 2021. However, underneath the good news are two lingering and significant pain points. Primarily, shelter costs (measured by what a property owner could receive in rent) are accounting for nearly 90% of the inflation gains, and auto insurance has increased a painful 16.5% in the last year. Because all of us need shelter – whether renting or owning – and most of us need auto insurance, these twin challenges can lead consumers to still feel gloomy and overshadow progress on other fronts such as energy and food. From the producer side of the inflation picture, August PPI increased a similar 0.2% and is up a low 1.7% year-over-year. So, the input costs for produced goods have declined, feeding through to lower CPI, and that should continue. On the housing front, as interest rates decrease, there is hope that housing markets will thaw and new home supply increase. Both presidential candidates have highlighted the need for increased home-building, and mortgage rates have begun to ease, with the average 30-year mortgage now at 6.2%.

The Fed has kicked off an easing cycle with a reduction in the key Fed Funds rate of 0.5% at their September meeting, and the target is now 4.75% – 5%. In their statement, they noted that “inflation is moving sustainably toward 2%, and [we] judge that the risks to achieving … employment and inflation goals are roughly in balance.” In other words, the economy is winning the inflation fight, and though we are closely watching employment for signs of trouble, those trends are positive, as well. Recession risk seems remote, barring a large exogenous shock (i.e., a “black swan” event). Further cuts appear to be in the cards to better line up rates with declining inflation, but recent strong job data (see below) means the Fed will not be in a hurry – cuts of 0.25% seem far more likely than the last 0.5% action. Remaining 2024 meetings are in November and December and will be closely watched.

Global economies remain divided. Generally, the US is strong relative to much of the rest of the developed world. Led by spending around artificial intelligence, US GDP in the second quarter was a solid annualized 3% and estimates for the third quarter remain in that range, contrasted with annualized Eurozone GDP of 0.6%. Asia is generally positive, and the recent large stimulus package from China has provided a boost to hopes for both Chinese stocks as well as emerging markets.

The US labor market is showing sustained strength. September’s jobs report reflected 254,000 new jobs, well above estimates, and importantly, a large majority were permanent positions. Gains were led by hospitality and healthcare, but an encouraging 25,000 new construction jobs were also reported. And wage growth over the prior 12 months was 4% – solidly outpacing inflation. There are 8.04 million jobs available, roughly 1.1 jobs per person searching – essentially where things were pre-pandemic. So, it remains a job seeker’s market, but future uncertainty is in the minds of workers – the level of people quitting and moving to new jobs is at the lowest level since 2015 (outside of the pandemic), indicating a preference for the “bird in the hand.”

The strength in the service economy is not surprising, as this sector has outshined manufacturing all year. Consumers generally have money in their pockets, given the wage gains in excess of inflation, and have spent on leisure and hospitality. While there are signs of strain for lower income consumers such as rising credit card and car loan defaults, spending on services is running at a 3% pace, and durable and non-durable – lower, but at a still-respectable 2% pace – both solidly in the green.

Stock markets worldwide have so far reflected the mostly positive data. In the US, the “Magnificent Seven” stocks that have led the way for much of the year showed signs of returning to earth, as their Q3 performance, while still positive, lagged the broader benchmarks for the first time since Q4 of 2022. Broader participation of gains across sectors is a healthy indicator. And as gains have moved beyond tech stocks and US shores, Gabriela Santos, JP Morgan’s Chief Market Strategist for the Americas, recently suggested “following your “ABC’s”: Appreciate the strong year underway but broaden your portfolios by reducing the concentration of your stock exposure to the handful of US names that have seen such outsize returns. As value, small cap, and ex-US stocks have joined the party, her advice rings true and reminds us that diversification is a benefit to portfolios. While there can be occasional FOMO – fear of missing out – as a certain sector or group of stocks explodes upward, they inevitably lose that leadership and owning a larger basket shines. It’s boring but true – diversification works to lower the risk and volatility in portfolios.

Lastly, a word about cash. Higher short-term rates have made money markets and short-maturity CDs an attractive, low-risk place to hold assets, and investors have responded by parking over $6 trillion – yes, you read that right: trillion with a “T” – in money markets. While understandable, as interest rates enter what is likely to be a period of declines, the relative allure and performance of cash will be pressured. Cash is an important portfolio tool for near-term needs, but historically lags far behind bonds and stocks over longer periods. Importantly, the time to move out of cash to other investments is early in the lowering cycle, because markets look ahead and price in changes quickly. Since 1984, data from JP Morgan show that following a peak in rates during a cycle, the subsequent 12-month return of 6-month CDs (a cash proxy) has been doubled by core bonds (7% vs 14%), and roughly tripled (7% vs 20%) by a 60/40 stock/bond portfolio. Look at it this way – cash is a necessary part of all our situations, but as rates fall, there is a significant opportunity cost to holding more than is needed. What is that cost? Leaving historically solid returns on the table. We want to stress that cash is critical for short-term planning, but likewise encourage you to talk with your advisory team about optimum levels of cash at this stage of the economic and market cycle.

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JFS Wealth Advisors, LLC [“JFS]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from JFS. JFS is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the JFS’ current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.jfswa.com. Please Remember: If you are a JFS client, please contact JFS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.