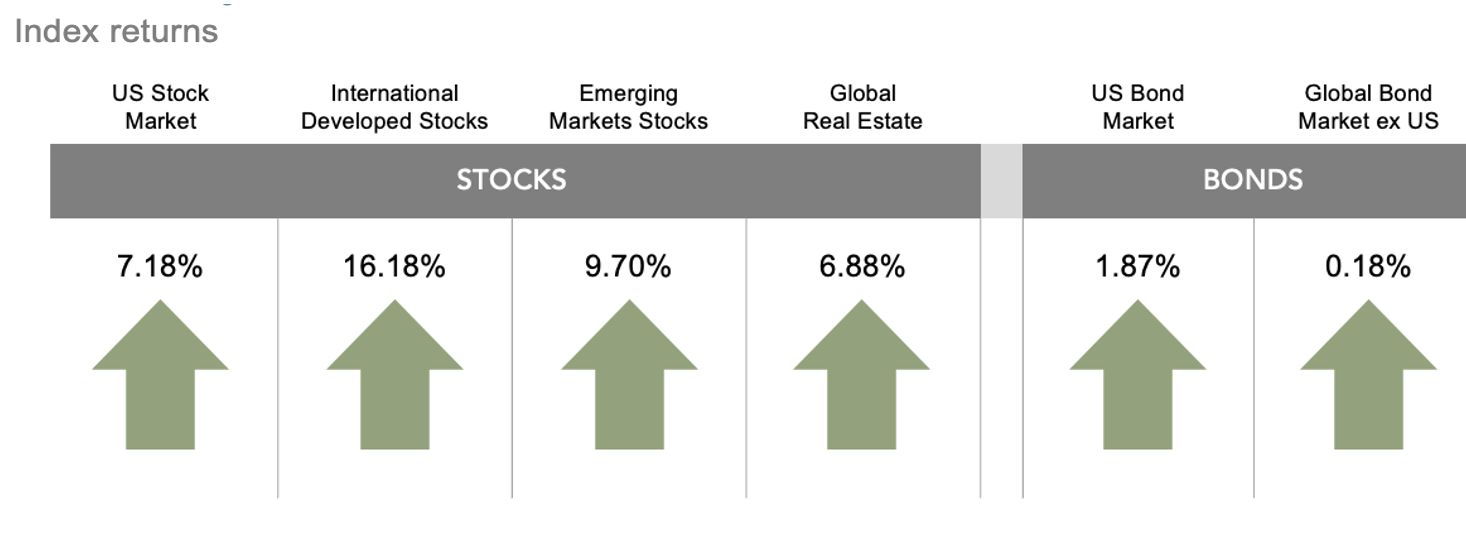

It seems likely that many investors may be thinking, “good riddance” as we put 2022 behind us and enter 2023. In the face of persistently high inflation, central banks around the world reversing the economic stimulus measures they put in place during the pandemic (i.e., tightening the money supply), a reordering of global supply chains and services because of Russia’s Ukraine invasion, all topped off with rising fears of recession, both stocks and bonds suffered during 2022. While, as the chart reflects, the 4th quarter was positive, for the full year the broad US stock market declined 19.2%, small US companies as measured by the Russell 2000 decreased 20.4%, international developed markets fell 14.3%, and emerging markets were down 20.1%. Similarly, an environment of rising interest rates held back bond returns, with the Bloomberg US Aggregate Index falling 13%.

US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net dividends]), Emerging Markets (MSCI Emerging Markets Index [net dividends]), Global Real Estate (S&P Global REIT Index [net dividends]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global.

US economic data is now mostly rolling over and pointing toward a slowing economy. The latest measure of manufacturing PMI was at 49 (below 50 indicates contraction), the first decline since May 2020, led by reductions in new orders. We see a similar story in China, where continuing COVID disruptions are a drag on the economy. In fact, the global composite PMI reading of 48 is down from a 10-year average of 52. Pending home sales in the US fell 4% in November, and mortgage rates north of 6% continue to weigh on the housing market as the spring season appears around the corner. Whether or not a recession begins in 2023, most data point unambiguously toward deceleration in growth with all eyes on the delicate balancing act being attempted by Federal Reserve as the economy teeters between cooling inflation—the much-desired “soft landing”—and tipping the economy into decline—the undesirable recession scenario.

For this reason, the Fed remains in the spotlight. After hiking interest rates seven times in 2022 to 4.25%–4.50%, they signaled in their December meeting that, while likely slowing the rate of increase, they intend to keep interest rate pressure applied until a cooling is seen in the US labor market. The good news is that markets are beginning to believe inflation will cool; forward indicators of inflation as measured by the breakeven rates are 2.32% in 5 years, and 2.27% in 10 years. On the other hand, the January 6 jobs report showed a strong 223,000 new jobs created—slightly more than analysts had predicted—meaning that there are roughly 1.7 jobs available for every person looking for work. While this is good news for unemployment, the flip side is not-so-good news: with the Fed focused on cooling wage pressures, they may continue to apply pressure until we see a painful decrease in a hot job market—a bitter pill for the economy to swallow, if it comes to that.

The 10-year US Treasury bond ended the year at 3.87%, more than double its rate of 1.5% when the year began. A welcome decline in gasoline prices has resulted from falling crude prices, which ended the year at just over $80/barrel. Rising rates in the US have led to the dollar strengthening against all major currencies. Gold, which typically moves opposite to the dollar, declined by $ 7.55 for the quarter, ending at $1,670.50 per ounce.

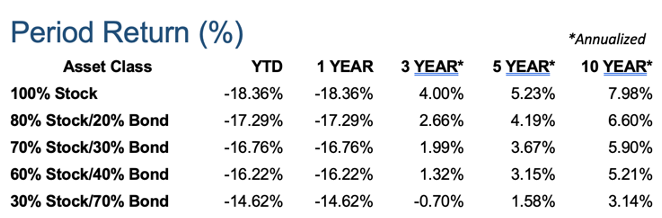

Indices used for hypothetical portfolios returns are the MSCI ACWI for equities and the BBgBarc US Agg Bond for fixed income. All data derived from Morningstar Office. Past performance is no guarantee of future returns.

JFS Wealth Advisors’ investment strategies are built around the knowledge that, over the long run, financial markets are efficient in determining reasonable asset valuations. The time-tested principles of low costs, low turnover, broad global diversification, and, where desirable, tax efficiency, are at the heart of our research, process, and portfolios. If you would like to review your current plan or you have other questions, JFS Wealth Advisors would love to hear from you.