Positive Surprises and Contrasting Signals in the 2023 Markets and Economy

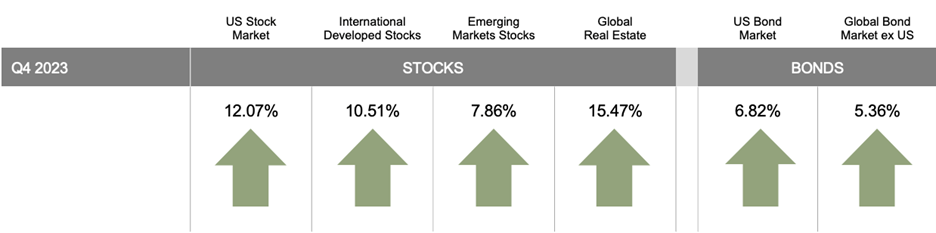

Santa Claus came early to financial markets in the fourth quarter of 2023. Following a weak fall and a low point in late October, stocks abruptly rallied on indications from the Federal Reserve that they were at or near the end of the current rate-hiking cycle. For the quarter, the broad U.S. stock market as measured by the Russell 3000 index gained 12.1%, the S&P 500 climbed 11.24%, and small US companies as measured by the Russell 2000 topped the pack with a gain of 13.55%. International developed markets rose 10.51%, and emerging markets climbed 7.86%. Hope for lower interest rates also sparked a furious rally in U.S. bond prices, with values jumping more than 8% in just over two months. Over the quarter, the Bloomberg Barclays Aggregate climbed 6.82%.

US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net div.]), Emerging Markets (MSCI Emerging Markets Index [net div.]), Global Real Estate (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg Barclays US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Barclays Global Aggregate ex-USD Bond Index [hedged to USD]).

The fourth quarter capped a year that proved many pundits wrong. A widely anticipated U.S. recession did not materialize, with labor markets remaining solid while inflation cooled. Instead of the feared drop-off in growth, an elusive “soft landing” could be in sight for the economy, with inflation returning to the Fed’s target zone and a strong jobs market continuing to provide disposable income to workers (which will help to keep the economy humming). This outlook led to strong stock performance for the full 2023 calendar year with the Russell 3000 climbing 25.96%, the S&P 500 up 24.2%, and developed international stocks rising 17.94%.

Key drivers of the positive surprises in 2023 were sustained economic strength, an easing of inflation as many (but not all) supply chain issues healed, a burst of enthusiasm around the future potential of artificial intelligence (AI) applications, and a Federal Reserve signaling a likely end to two years of rising interest rates.

Yet buried in the fine print beneath the headline positive surprises remain contrasting signals, and as we’ve noted in previous comments, economic data points to a divergence in growth trends.

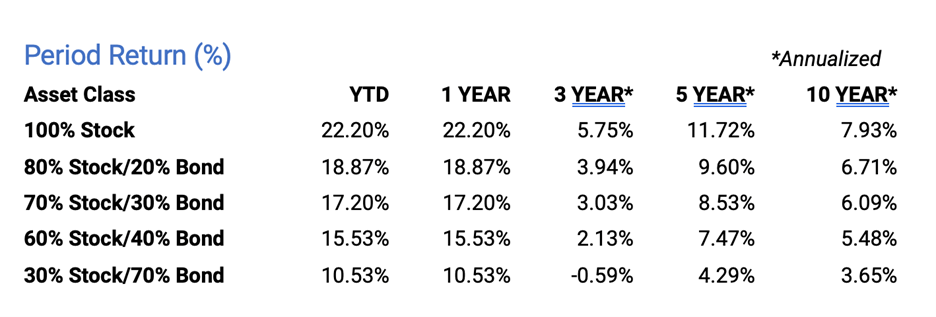

Indices used for hypothetical portfolios returns are the MSCI ACWI for equities and the BBgBarc US Agg Bond for fixed income. All data derived from Morningstar Office. Past performance is no guarantee of future returns.

Leading economic indicators have been in a steady decline, down 3.5% in the last 6 months, resulting in the Conference Board reiterating their call for a shallow recession in 2024. Manufacturing data remains weak; the December ISM manufacturing reading of 47.4% indicates contraction and reflects the 14th negative month in a row. And while the U.S. consumer continues to spend, the ISM Services Index December reading of 50.6% reflects a marked slowing from earlier in the year, indicating that household finances are becoming tighter as excess pandemic-era savings are depleted.

Unemployment of 3.7% remains a bright spot, and an early January ’24 jobs report indicated 216,000 new jobs were created in December. There are some 8.79 million open jobs, and with 6.3 million unemployed, the ratio of open jobs to job seekers is at 1.4:1, a dramatic drop from earlier numbers that were over 2:1. This reflects two dynamics: a declining number of open positions, and less job-switching as more stay with their current employer. In other words, much of the froth that was seen in the job market is gone, and a more stable environment is in place.

In the U.S. stock market, an impressive headline 24.2% return for the S&P 500 masks a large divergence in fortunes. The turbocharged “Magnificent Seven” stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla) accounted for 2/3 of the return of the index, gaining between 50% and 240% in price, far outpacing the other 493 index companies. And the top 10 stocks provided 90% of returns—a troubling concentration. Recall the frenzy around the dotcom bubble of 2000 and the more recent FAANG stocks. High-fliers eventually return to Earth. Nothing stays up forever, and a more vigorous and healthier environment should raise the fortunes of all companies, not just a few. Whether that occurs in 2024 remains, of course, to be seen.

Turning to the Fed, their Open Market Committee met twice in the fourth quarter and made no changes to the benchmark federal funds rate, which at 5.25%–5.5% is still at its highest since 2000. The U.S. central banks justified this action due to a slowing economy and cooling inflation. As already noted, in December the committee hinted that if conditions persist there could be a potential of three rate cuts for 2024, with this “pivot” in language leading to glee for both stock and bond prices.

What has the Fed seen to justify their change of heart? The latest CPI report of 3.14% continues to point to welcome progress on high prices for goods and services (recall the high of 9.1% just 18 months ago, in June 2022), and the Fed’s favorite inflation measure, the PCE (Personal Consumption Expenditures) declined to 3.2% year-over-year from 4.9% at the start of 2023. Coupled with a jobs market as noted above that, while healthy, is gradually easing, and an overall strong economy with GDP annualizing near 5%, the Fed seems to be in full glide path mode, hopefully piloting the economy toward a smooth landing and no recession.

The 10-year U.S. Treasury bond ended the quarter at 3.86%, declining by nearly 0.75%, and interestingly, yielding almost the same as its January 1 level of 3.87%. Yet underneath that seeming calm were large swings, with the 10-year Treasury rate exceeding 5% multiple times before retrenching at year-end. It’s noteworthy that the Fed proceeded throughout the year with ending their quantitative easing programs. In 2023, the Fed’s balance sheet shrunk by $840 billion as they were net sellers of Treasuries and mortgage securities, surprising many by not creating more market stress in the process.

Looking to other areas, despite rising Mideast turmoil, crude oil prices for the quarter plunged 22%, as ample supplies and lackluster demand led to a closing price of $71.30. The price of gold increased by 11%, ending the quarter at $2,072.50.

The year 2024 will, no doubt, be one that will, like all others, surprise on many fronts. We know that a contentious U.S. election (and some important international elections as well), is looming, global unrest and conflict, headlined by the Middle East, has surged, and the disruptive technology of AI looms large over companies and society. What should not surprise us, however, is our commitment to in-depth planning for our clients and carefully constructed investment portfolios designed to stand the test of time. We will walk alongside you as we navigate the seas ahead and will always have your best interests and outcomes at the forefront of all we do. On behalf of all our JFS colleagues, thank you for your continued confidence, and best wishes for a healthy, happy, and prosperous New Year.

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JFS Wealth Advisors, LLC [“JFS]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from JFS. JFS is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the JFS’ current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.jfswa.com. Please Remember: If you are a JFS client, please contact JFS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.