Navigating 2024’s Market Close: Insights and Strategies for 2025

Fourth-quarter 2024 results were shaped by November’s U.S. presidential election. As financial markets around the globe began to incorporate the implications of a Trump “2.0” presidency, the landscape shifted. U.S. interest rates rose, U.S. stocks rose, vacillated, and finally weakened to close out the year, while overseas stocks fell. For the full quarter, broad U.S. stocks as measured by the Russell 3000 index gained 2.6%, the S&P 500 rose 2%, and small U.S. companies as measured by the Russell 2000 eked out a gain of 0.1%. International developed markets fell 7.4%, and emerging markets declined 8%. Following a solid year until mid-September, bond prices gave ground, with the Bloomberg Barclays Aggregate declining by 3.1%.

US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net div.]), Emerging Markets (MSCI Emerging Markets Index [net div.]), Global Real Estate (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg Barclays US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Barclays Global Aggregate ex-USD Bond Index [hedged to USD])

Peter Bernstein, the first editor of the prestigious Journal of Portfolio Management and well-known economist and author, once noted presciently that “Forecasts create the mirage that the future is knowable.” As has been proven over and over, surprises, rather than knowable certainty, are the norm, so looking through a cloudy crystal ball should be an exercise accompanied by a strong dose of humility. With that as a cautionary reminder, let’s look at how the year ended and where things may go in 2025.

Financial Markets

The full year was strongly positive for U.S. stocks, as hopes for AI-fueled growth drove the mega-cap “Magnificent Seven” (Microsoft, Amazon, Meta, Apple, Alphabet, Nvidia, and Tesla) to an average 2024 gain of 63%. Given their roughly 1/3 weight in the S&P 500, they led the index to an annual gain of 23%. Outside of the biggest of the big, returns were also positive, albeit on a much smaller scale. Smaller U.S. companies as measured by the Russell 2000 grew 11.5%, International developed markets rose 4.7%, and emerging markets gained 7.5%. Bonds were once again a distant second fiddle to stocks, rising 1.25% for the year.

Yields on the 10-year U.S. Treasury bond spiked by 77 basis points, ending the quarter at 4.57% (remember, when bond yields rise, bond prices decline). Crude oil climbed by 5%, finishing the quarter at $71.76. The price of gold was nearly flat, decreasing by 0.61%, closing the quarter at $2,638.50, although increasing over the full year by 26.6% as inflation proved persistent and the dollar strong.

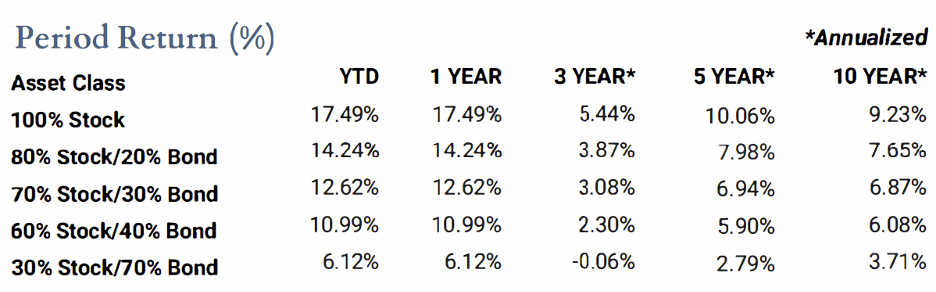

Indices used for hypothetical portfolios returns are the MSCI ACWI for equities and the BBgBarc US Agg Bond for fixed income. All data derived from Morningstar Office. Past performance is no guarantee of future returns.

Interest Rates

In its December meeting, the Federal Reserve cut its benchmark rate target range to 4.25%– 4.5%. This was the third cut, totaling 1% in 2024, but was accompanied by a statement that suggested the pace of rates in 2025 would likely slow. The next Fed meeting is January 29, and data releases are being closely parsed for clues as to what the Fed may do.

Why the cautious tone from Jerome Powell? Inflation, while clearly falling, remains stubborn and in play. Twelve-month CPI currently sits at 2.7%, above the Fed target of 2%. Add in tough trade and immigration rhetoric from the incoming administration along with a strong job market, and worries about inflationary pressures persist. Chair Jerome Powell noted in the December Fed statement that “Inflation … remains somewhat elevated,” and the FOMC members’ “dot-plot” forecasts for 2025 indicated fewer future rate cuts than originally anticipated. This has roiled both bond and stock markets, as a “higher for longer” rate scenario appears increasingly likely.

The Economy

The U.S. economy is healthy. The latest GDP annual rate of 3.1% is solidly positive, reflecting steady consumer demand and steady job markets. New job creation in December was 256,000, and unemployment remains a low 4.1%. There are some 8.1 million job openings and 7.7 million unemployed, a ratio of 0.9 job seekers for every open position. Contrast that with the pandemic high of 3.7 seekers per position, and it is clear that jobs are available for those who want to work. Importantly, the unambiguously positive trend of wage growth exceeding inflation has been in place for twenty straight months now, putting real spending power into consumer pockets and leading to consumer spending rising at a nearly 4% annual rate.

Yet a bifurcation in economic growth remains, as manufacturers struggle while services stay strong. Manufacturing data has declined for nine consecutive months, but services data has grown for six as restaurants and entertainment venues boom. This juxtaposition feeds into the uncertainty around tariffs and labor disruptions and their impact on factories and production, as many manufacturers report stockpiling needed input inventories in fear of rising prices due to tariffs.

Globally the economic picture is similarly mixed. The Eurozone is struggling against lingering inflation and political turmoil and is posting an annual GDP growth rate of just 0.4%, China continues to fight to increase domestic consumption as their GDP has slowed to roughly 5%, and emerging market GDP is expected to come in just above 4% for 2025.

Financial Markets into 2025

If we accept the premise the future is unknowable, then can we reasonably look ahead? Absolutely, if we do so with humility, a focus on hard data that tells us where we are, and willingness to accept there will certainly be different outcomes than we think. As always, what transpires will be a mix of the expected and the unexpected. With that as a backdrop, what are we seeing today?

For equities, 2024 marked the first time in over 20 years there have been back-to-back 20+% gains in the S&P 500, an anomaly leading many pundits to either proclaim through rose-colored glasses an outlook of more gains to come, or, on the other side of the coin, to project an impending pullback. While only time will tell on the end results, what we do know in this moment about global equity markets is this:

- U.S. large-company stock indices are at extreme comparative levels. GMO and JP Morgan have both recently noted that the P/E of the S&P 500 is nearly 2.5 standard deviations more expensive versus the MSCI All Country World Index ex-U.S. – a dramatic difference. And U.S. stocks now comprise nearly 70% of world stock market capitalization, well above the previous high-water mark just over 50% in 2003. Looking at company earnings, analysts are pricing in 14% growth for the S&P 500 in 2025, while 2024 was only 9% – perhaps an overly optimistic outlook. Consider also that the top 10 stocks comprise nearly 40% of the S&P 500 – an historically high concentration that means just a few stocks are determining overall index performance. These facts portray a U.S. stock market at levels that history and common sense tell us are unlikely to persist.

- Yet, all the above does not mean that indices are bound to implode. Indeed, these levels and concentrations are understandable, as the largest companies have been extraordinarily profitable and have seen explosive growth. With the excitement around AI and its growing application in business and daily life, an argument can be made that the valuations are deserved – unlike the tech bubble of 2000, when companies without even a hint of profits were driven to similar levels. The challenge is that blazing growth eventually slows and high valuations then are repriced. How and when this occurs is – you guessed it – unknown, but there are prudent portfolio steps to take.

- Without abandoning mega-cap U.S. companies completely, considering other areas and countries that are deeply out of favor makes sense. If U.S. stock indices are historically expensive, then it stands to reason that foreign stock markets are historically cheap. And indeed that is the case, as we have noted above. Typically, when long-standing comparative market ratios exceed 1 standard deviation, that is an indication to sit up and pay attention, because a return to the norm is likely to occur. With the 2.5 measure (as discussed above) that exists today, international stock markets are eye-catching. Again, to be fair, they are understandably cheap, given the dominance of U.S. giant companies in the recent past, and a catalyst for a quick rebound is hard to see. But no good thing lasts forever; careful exposure to stocks outside the U.S. is sensible.

- Digging a little deeper, many emerging markets are benefiting from the Trump tariffs of 2018, which have seen Chinese exports to the U.S. fall by nearly half. That slack has been picked up by other countries such as Mexico, Vietnam, and Thailand. Should a new round of tariffs be enacted, this dynamic could continue, driving growth in many emerging markets outside of China.

- A valuation story also exists within the U.S. market itself. Large growth companies are trading at nearly 150% of their 20-year valuation averages, while large, mid-cap, and small value stocks are markedly lower. As with international equities, thoughtful exposure to those areas makes good portfolio sense.

- Shifting gears to fixed income, while it is easy to dismiss core U.S. bonds as a has-been, given the stellar stock market and the likelihood of fewer Fed rate cuts than first anticipated, we believe they deserve an important role in balanced portfolios. High-quality core bonds are yielding approximately 5% today, exceeding money markets. Default risks are historically low, and there is the added opportunity for price appreciation should rates fall farther than expected. It is also vital not to forget that bonds can provide portfolio ballast, steady income, and peace of mind when stocks fall. While it would be a mistake to expect bonds to match stocks over time in returns, their lower volatility and steady income make them an important portfolio component to consider.

A New Year is sometimes taken as a springboard to a “new me,” with gym memberships spiking, many articles about healthy diets, and plentiful advice on how to plan for life success. While all of these can be good for our personal well-being, portfolio wealth creation over the long run is best served by consistency, patience, and sticking to proven, tested approaches, not a fresh attempt every January 1. Your advisory teams know this and have financial plans and portfolios designed to deliver realistic results over all market cycles. Please reach out to them with any questions.

From all of us at JFS, the very best wishes for a healthy and happy 2025.

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JFS Wealth Advisors, LLC [“JFS]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from JFS. JFS is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the JFS’ current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.jfswa.com. Please Remember: If you are a JFS client, please contact JFS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.