Following a tariff-induced, rollercoaster plunge to start the quarter, global financial markets stabilized and steadily improved over the three months ended June 30. While Israel’s June strikes on Iran induced another bout of uncertainty, it was short-lived, and within the past few weeks stocks regained their highs.

US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net div.]), Emerging Markets (MSCI Emerging Markets Index [net div.]), Global Real Estate (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg Barclays US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Barclays Global Aggregate ex-USD Bond Index [hedged to USD])

For the full quarter ending June 30, broad US stocks as measured by the Russell 3000 index gained a solid 11%, the S&P 500 rose 10.5%, and small US companies as measured by the Russell 2000 climbed 8%. International developed market stock prices continued a stellar 2025 to-date, rising 12% for the quarter and 18% since January 1, and emerging market stocks gained 12%. Although interest rates were volatile in reaction to world events, US bond prices showed little net movement from start to finish of the quarter; with the Bloomberg Barclays Aggregate up 1.2%.

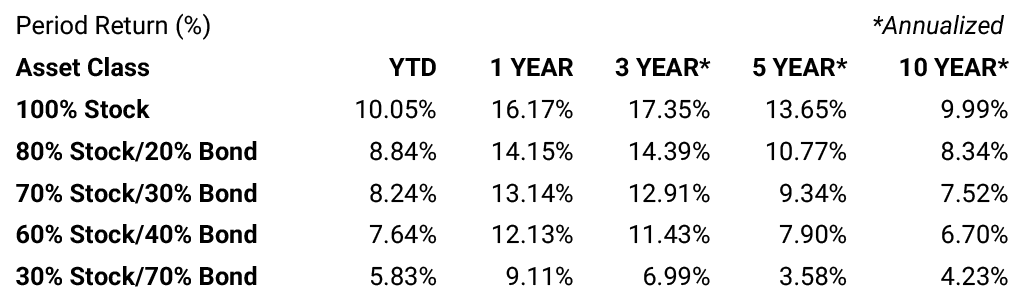

Indices used for hypothetical portfolios returns are the MSCI ACWI for equities and the BBgBarc US Agg Bond for fixed income. All data derived from Morningstar Office. Past performance is no guarantee of future returns.

As is so often the case, financial markets befuddled many prognosticators by showing resilience and even optimism in the face of worldwide turmoil. Taken at face value, a quarter marked by trade war fears bursting into play on April 2, the continuing military conflicts in Ukraine and Russia, capped off with the eruption of a bombing campaign in Iran, seemingly would result in a sharp “risk-off” posture by investors in both stocks and bonds. And yet, while there were brief moments of that sentiment, the longer view prevailed, leaving fear-driven sellers of stocks and bonds far behind in the portfolio growth game.

The Federal Open Market Committee once again chose to leave the federal funds rates unchanged following their June meeting. We noted last quarter that President Trump, in an unusually public manner, has been pressuring Fed Chair Jerome Powell to resign. The typically cautious Fed has held interest rates steady this year after three rates cuts last fall, despite loud claims from the White House that rates should be cut. While tensions between the Fed and presidential administrations are nothing new, why the very public disconnect now? In the face of continuing uncertainty around on-again, off-again trade tariffs, the Fed Open Market Committee is focused on the possibility of inflationary pressures. Economics 101 suggests that tariffs are often passed through to consumers in the form of higher prices, creating a potential upward inflationary spiral. Given a stable job market and buoyant stock prices, the Fed is content to watch and wait as the tariff outcomes become clearer.

Contrast that viewpoint with a White House that is determined to buck conventional economic wisdom and demonstrate “wins” with its aggressive trade strategy. As inflation so far remains in check, the White House wants lower rates as a tailwind. Chair Powell’s term expires in May 2026, and a resignation seems unlikely. Until then, any steps taken to remove Powell from his role would likely be poorly received across markets and economies. One of the enduring strengths of the American financial system is an independent central bank, tasked with long-term stabilization of employment and growth and not swayed by short-term political goals. While the Fed has indeed missed the mark more than once in its history of interest rate decisions and Powell has at times seemed slow to incorporate new data, the steady and independent hand of the Fed is a critical part of American economic success, and interference with that system is a concern.

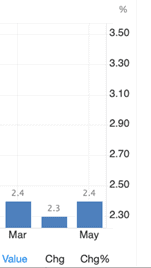

Inflation data through May 31 showed negligible impact from tariffs. For the past 12 months prices the Consumer Price Index rose by 2.4%, close to the Fed’s stated 2% target. And the Fed’s preferred measure, the Personal Consumption Expenditures Index, rose in May by 2.3% year-over-year. Current Fed projections suggest rate cuts are in the works by year’s end; more light will be shed on the picture following the Fed’s upcoming July meeting. Until then, the war of words and wills between an impatient White House and a patient Federal Reserve seems likely to continue.

Inflation rate change (CPI), March–May 2025. SOURCE: US Bureau of Labor Statistics

The U.S. jobs market continues to defy predictions and remain in growth made. The June jobs report (issued July 3) exceeded expectations, with 147,000 new jobs created, ahead of both the 144,000 May number as well as the 146,000 year-to-date average. Unemployment at 4.1% continues quite low, and wage growth over the past 12 months was 3.7%, keeping an important lead over inflation.

Overall economic growth paints a somewhat different picture. The latest snapshot of US GDP through March 31 reflects an annualized contraction of 0.5%, led by a significant decline in imports as tariff fears roiled the waters. For the most part however, the worst-case scenarios of a global trade war feared by many have not materialized. Instead, following bombshell proposed tariff rates announcements, deals are subsequently reached or implementation postponed. So, while legitimate questions may remain around the staying power of this growth, there is no denying that the resiliency of the US jobs market and economy in the face of tariff headwinds and global volatility has been a positive surprise.

Yet all is not roses. Forward-looking indicators reflect uncertainty. The Conference Board’s Index of Leading Economic Indicators declined by 0.1% in May after falling 1.4% in April and is now down 2.7% over the past 6 months. ISM manufacturing data fell in June and have declined 30 of the past 32 months, reflecting an economy focused more on services than manufacturing. But services data, while slowing, have stayed positive. Comments from business executives point to worries about a future framed in unknowns. In such an environment it is challenging for businesses to commit to their engines of growth – people, plants, and equipment. So, put it all together, and there is rising caution around slowing growth.

One clear point that has resurfaced in 2025 is the benefit of investment diversification. Following a lengthy period of US stock market dominance, international stocks have stepped back into the limelight. Through June 30, the return on EAFE, the broad measure of international developed stocks, is over 18% and has nearly tripled – yes, you read that right – the return on the S&P 500. A weaker dollar has boosted foreign stock prices, but a deeper sentiment shift has also occurred, as investors widen their lens for many reasons. Such a shift seems likely to continue, providing benefits to portfolios with international exposure.

Bonds have also provided more of their traditional offset to stock volatility, meaning that the wisdom of balanced portfolios – cash, diversified stocks, and high-quality bonds – is again apparent.

Yield on the 10-year treasury was virtually unchanged, ending the quarter at 4.23% (prior quarter end was 4.24%). Crude oil prices fell by 8.81%, finishing the quarter at $65.09. The price of gold continued to rise, gaining another 5.16% in Q2, closing the quarter at $3,319.30.

At this writing, the House has passed the revised Senate version of the “Big, Beautiful Bill.” In many ways, this bill is a microcosm of the macro shifts underway as the Trump administration moves aggressively to put its stamp on governing. A main feature of the bill is making permanent the existing tax cuts from the 2017 Tax Cuts and Jobs Act, many of which were scheduled to expire at the end of this year. The implications of the bill will take time to fully understand and incorporate. We will write more as those become clear.

If you have questions about how these developments could affect your financial strategy—or how to ensure your portfolio is properly diversified in this changing environment—our team at JFS Wealth Advisors is here to help. Reach out to your advisor directly or contact us to schedule a conversation. As always, we’re committed to helping you stay informed, confident, and aligned with your long-term goals.

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JFS Wealth Advisors, LLC [“JFS]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from JFS. JFS is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the JFS’ current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.jfswa.com. Please Remember: If you are a JFS client, please contact JFS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.