It is no secret that interest rates in the U.S. and developed international countries have climbed dramatically – rising primarily in response to inflation pressures not encountered for many years. The underlying causes are varied but stem from two fundamental issues – the COVID-19 pandemic and its worldwide supply disruptions, and (with much political finger-pointing from both sides of the aisle) highly stimulative fiscal policy stretching back to the 2008 Great Financial Crisis. An extended period of low rates and accommodative global trade and markets has, arguably, ended.

Rapid rate rises have impacts – some quickly seen, such as higher yields on savings accounts and money markets, and others less desirable, manifesting with a lag, such as a drag on economic growth due to increased costs of debt and financing for consumers and businesses. As we write this piece, we appear to be at or near an inflection point – the lagging impacts of rate rises are beginning to be seen, and looking ahead to estimate economic growth is becoming much harder.

Humility is a necessary ingredient when peering down the road because outcomes are generally different than what is forecast. Warren Buffet drily noted, “There’s nobody’s predictions that we’re interested in, including our own.” observing that sticking to the knitting of daily work is a good path for success. But that said, let’s look at some observations about today – and the future.

A note here that a looming potential government shutdown due to the inability of Congress to approve a budget seems a real possibility. If that were to happen while having an immediate negative impact on markets and the economy, it would not change the underlying premise of this piece’s focus on interest rates and their long-term impacts.

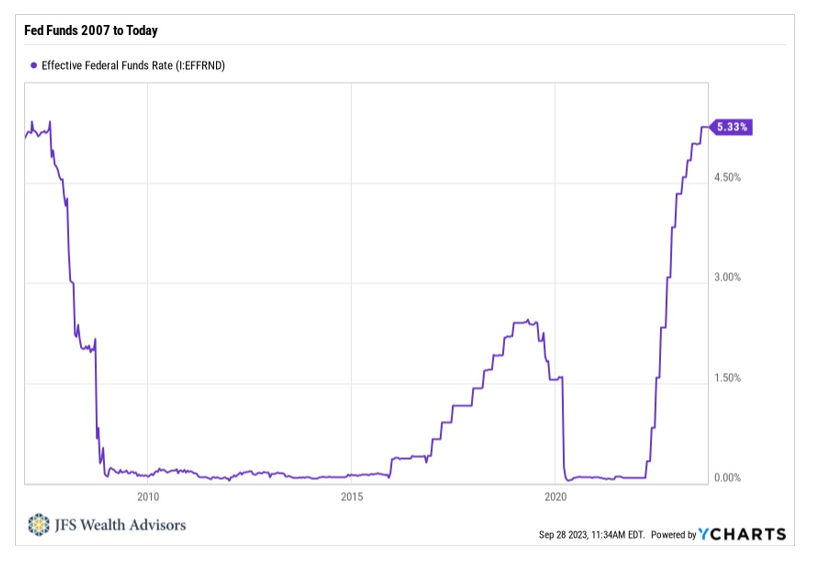

The chart below shows that rates in the U.S. today are at 15+ year highs.

The extended period of near-zero rates beginning after the 2008 Financial Crisis had profound impacts as borrowing costs became less of a concern. With mortgage rates at 3% and savings accounts paying next to nothing, an incentive was strong to borrow as well as have money invested in real estate and other risk assets. In other words, put your money outside of cash or bonds. It’s a different ballgame today.

Liz Ann Sonders of Schwab recently discussed an end to the “Great Moderation” a period she characterized as… one during which disinflation reigned, economic volatility was subdued—save for the global financial crisis—and there was a steady tailwind associated with the epic decline in interest rates.” Banks were a canary in the coal mine to such changes afoot this spring, as poor balance sheet management left many with huge mismatches of liabilities – long-term bonds paying low coupons held as capital, while the new environment demanded higher levels of interest paid on deposits. The ensuing chaos and loss of customer confidence caused panicky depositor withdrawals and several well-publicized failures, and while fears have eased, many mid-size banks today remain on thinner balance sheet ice than they would prefer.

Beyond banks, American consumers who entered the workforce and started families post-2008 have never encountered rates like this. Accustomed to near zero cost of capital, mortgages at 7%, car loans approaching 9%, and credit card payments at an average of 20.7% are a shock to budgets. The WSJ recently ran a piece entitled “Rates are Up. We’re Just Starting to Feel the Heat”. The thrust was that while recession fears due to higher rates appear to have lessened for now, the economy is not yet out of the woods, as many impacts of higher rates are just starting to be felt. Looking beyond consumers to consider corporations and commercial real estate, the horizon may be even darker. Over $1 trillion per year in corporate debt is maturing from 2025-2028, and sharply higher refinancing costs will impact bottom lines. Commercial real estate has made headlines as defaults on downtown office buildings are occurring in prime locations such as Los Angeles and Washington DC. $1.5 trillion in commercial real estate loans will mature in 2025, likely leading to more pain, and salivating distressed “vulture” investors are waiting eagerly to buy properties for pennies on the dollar. Oh, and we have not even gotten to one of the biggest debtors of all – the U.S. government! Nearly 70% of low-rate government debt matures within the next 5 years, and new debt is being issued at current much higher levels. Interest payments on the national debt were $475 billion in fiscal year 2022, up 35% from the prior year, and forecast (there’s that word again) to jump another 35% for fiscal 2023. The economic drag of these payments is sure to be felt, it is just a question of when.

And what about inflation? As supply chains have improved, inputs to manufacturing and construction (Core PPI) are up 2.1% year over year, the lowest level since January of 2021, and Core CPI (prices paid by consumers, including imports) while higher is also improving, up 4.3% year over year. Energy and food have been wild cards in both equations, with the recent rise in energy prices causing alarm bells as prices increase at the gas pump, and the strike by auto workers raising fears of automobile price spikes returning.

While caution is rising and warranted, JP Morgan offered some interesting observations about capital spending recently. They noted that despite forecasts for slowing growth in the face of higher rates, capital spending has shifted rather than decreased. The AI wave, coupled with government incentives around technology and green building and energy, has kept investment spending resilient, growing 4.6% year over year. They posit this could signal a new emphasis on intellectual property investment – a type of spending that is less sensitive to higher rates. They noted “Clearly brains are becoming more favored relative to brawn when it comes to investment spending …” a development that can make spending far less sensitive to interest rates.

So, what does this all mean?

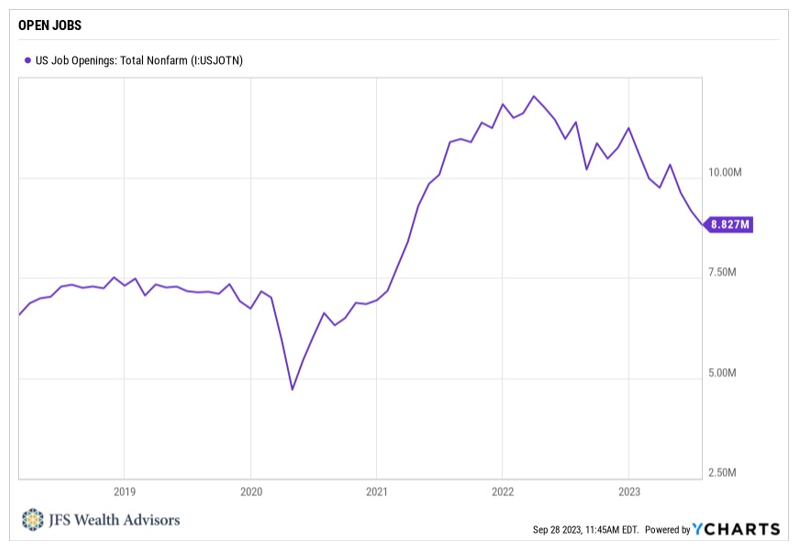

We are likely in a stickier rate environment. While inflation is cooling as supply chains normalize, it remains elevated due to strong demand. The Fed’s target of 2% may still take some time to achieve, and some are calling for a new “neutral rate” target of 3% – 4% as more realistic. The labor market has remained strikingly strong, keeping consumers spending. August retail sales jumped 0.6%, well above the 0.1% consensus estimate. These dynamics also are showing incipient signs of easing – job openings and labor turnover are down (see chart below), wage increases are slowing, and as debt service costs rise and student loan payments re-start, consumer spending is likely to slow, perhaps dramatically. But the much-anticipated recession that was headlines earlier this year seems to have – well – receded – into the background, at least for now. The yield curve remains inverted, generally a solid recession indicator, but with a lag. Recent studies show an average of nearly 600 days from the time of the first inversion to a recession, and today that number sits around 300. In other words, the yellow caution light is still flashing. A government shutdown could certainly deal a body blow, and the political uncertainties around impeachment inquiries, the Trump legal saga, and a contentious election cycle are likewise ominous clouds. But for now, a resilient consumer and a Fed committed to seeing lower inflation means higher for longer as the mantra.

In portfolios, perhaps the most significant implications center around bonds and cash. While the historic bull market in bonds that kicked off following the peak in rates in 1981 is not going to repeat itself, high-quality government and corporate bonds are once again attractive, no longer just as an offset to equity volatility. Many real (after inflation) bond yields are positive, meaning the fixed-income portion of portfolios can once again provide growth over inflation as well as steady income. Future returns for balanced portfolios will benefit from their bond components in a way they have not for some time. Cash equivalents such as money markets and T-bills are paying 5% or more, tempting many to want to beef up those holdings. While that rate is indeed attractive, we continue to view cash as a short-term holding best kept for specific needs. For longer-term investing goals, bonds fill a role cash cannot by offering the potential for price gains should interest rates fall. And make no mistake, rates will fall at some unknown time in the future, as the Federal Reserve will react to economic stress by lowering rates. Will we see zero again? Seems highly unlikely, but even if rates decline marginally, the benefits of bonds will be seen. The siren call of cash should be resisted when considering longer-term portfolio construction and investing.

Looking at stocks, prices have declined since the Fed began the current rate hiking cycle in March of 2022. The S&P 500 has lost 1.4% and International stocks as measured by EAFE are down 4.5%. In 2023, the S&P has risen 12% to date and International stocks 5.5%. But those figures mask a large disconnect. The handful of tech darlings in the U.S. known as the Magnificent Seven have driven almost all the S&P 500 positive returns. A measure of the S&P that equally weights each company has risen only 0.75%. Such concentration typically does not last, and with the Price/Earnings ratios of those 7 at a nose-bleed level of 56, the age-old adage of diversification across countries and styles is again at the forefront.

Rates now seem to be at or near peaks, and as such, bond portfolios should begin to add some of their own life to the party. Balanced portfolios have endured a challenging period of low rates, with equities seemingly the only game in town. That has changed, and we believe bonds and fixed income can once again be a major contributor to future returns.

While uncertainties abound, we know that careful planning in conjunction with prudent portfolio construction will make the most progress towards meeting goals. Tune out the noise as hard as it may be, and let long-term investing bring you its benefits. As always, please reach out to your advisory team with any questions specific to your situation. On behalf of all my JFS colleagues, thank you for the continued confidence you place in us.