Tariffs, International Trade and the Economy

Global financial markets in the first quarter of 2025 continued to be strongly impacted by the new US presidential administration. Rapid change and accompanying uncertainty have flowed outward from Washington, roiling stock markets and leading bond markets to incorporate a renewed emphasis on inflation. And on April 2, although technically in the second calendar quarter, President Trump announced a sweeping set of trade tariffs, kicking off global consternation and sharp corrections in stock prices. At this writing it remains unknown how far other countries may go with retaliatory tariffs, and what (if any) negotiation may be kicked off to soften the tariff blow to all involved.

Tariffs, trade wars, and their impacts are, for good reason, top of mind. For more perspective on this topic, following is a link to our recent webinar, “Post-Inauguration Economic and Market Update”.

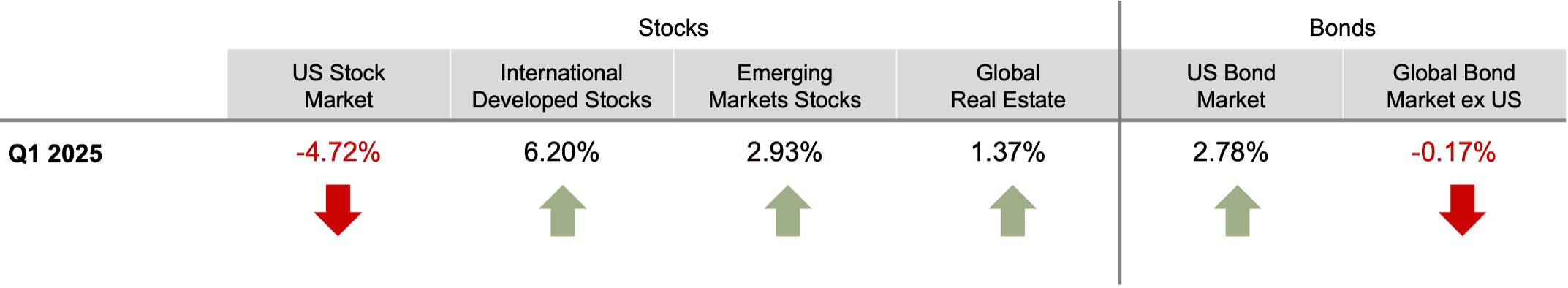

US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net div.]), Emerging Markets (MSCI Emerging Markets Index [net div.]), Global Real Estate (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg Barclays US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Barclays Global Aggregate ex-USD Bond Index [hedged to USD])

For the full quarter ending March 31, broad U.S. stocks as measured by the Russell 3000 index declined 4.7%, the S&P 500 fell 4.6%, and small US companies as measured by the Russell 2000 fell 9.8%. By contrast, in “a tale of two markets,” International developed stock prices rose 6.2%, and emerging markets gained 2.9%. On the fixed income side, US bond prices climbed, with the Bloomberg Barclays Aggregate up 2.8%.

Yields on the 10-year US Treasury fell by 33 basis points, ending the quarter at 4.24%. Crude oil prices were stable, finishing the quarter at $71.38. The price of gold had a sharp increase, gaining 19.63% and closing the quarter at $3,156.40.

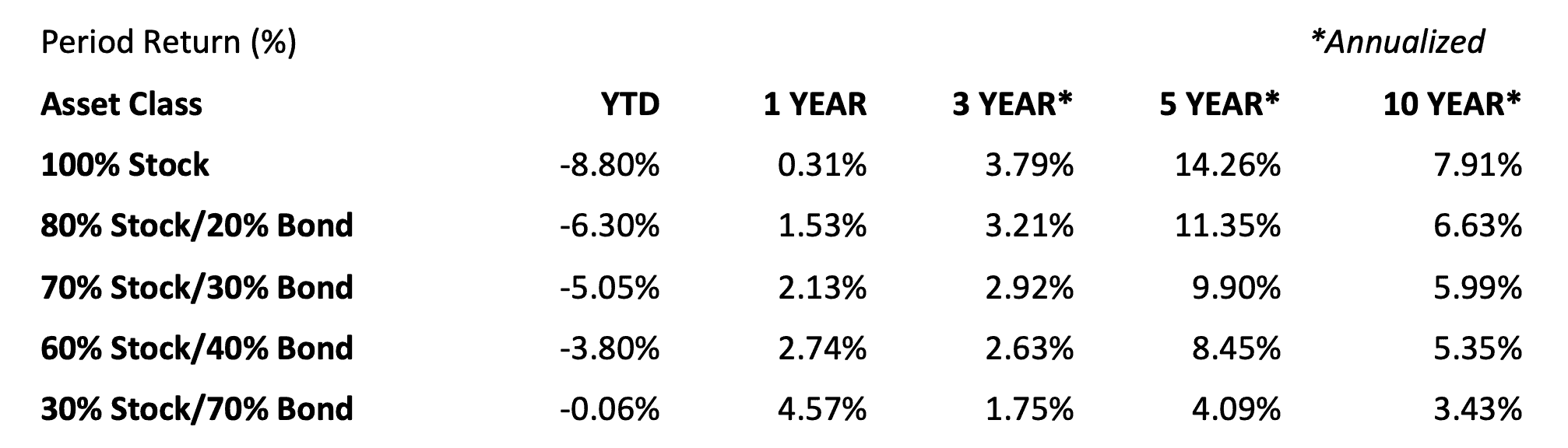

Indices used for hypothetical portfolios returns are the MSCI ACWI for equities and the BBgBarc US Agg Bond for fixed income. All data derived from Morningstar Office. Past performance is no guarantee of future returns.

The Federal Open Market Committee left their key federal funds rates unchanged following their March meeting. Fed projections at that time suggested two rate cuts of 0.25% by year’s end. However, the turmoil from April’s tariff announcements may well change the Fed response to future economic data. Some analysts are now calling for as many as 4 rate cuts if a recession materializes. Yet inflation at 2.8% is still above the 2% long-term target, backing an argument for holding rates where they are.

It is a tough time to be Jerome Powell. There is tension between turbulent stock markets and recession fears on the one hand, and the likely inflationary impacts of the tariff trade war on the other. While President Trump has publicly called for Jerome Powell to cut rates, the Fed has a very clear mandate to manage both employment and inflation. So far, Chair Powell and the Open Market Committee have followed the data and held steady.

So, while economic clouds do appear to be gathering, the US economy has entered the storm from a solid position. The latest jobs report exceeded estimates, with 228,000 new jobs created in March, and an unemployment rate of 4.2%. GDP growth was a positive 2.4% annualized rate at the end of 2024, and although likely slowing in Q1, seems on track to show a small positive gain. However, as the large governmental layoffs work their way through the system, and with the possibility of a potential economic slowdown due to a trade war, this benign picture may darken. Leading economic indicators fell in February and have now fallen 1% since August of 2024. ISM manufacturing data fell in March, and services data, while slightly positive, slowed significantly from the month prior. Put it all together, and there is rising caution around slowing growth.

Though uncertainty abounds in the markets, your JFS advisors are always available to provide authoritative guidance, based on sound financial research and delivered with your best interests foremost. If you have questions or concerns, please get in touch with us.

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JFS Wealth Advisors, LLC [“JFS]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from JFS. JFS is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the JFS’ current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.jfswa.com. Please Remember: If you are a JFS client, please contact JFS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.