As the largest market in the world by far, the United States financial markets certainly have pride of place in many investors’ minds. In fact, the thought of broadening portfolio holdings to include international equities or fixed-income investments could generate reactions ranging from “Why bother?” to “Too risky.”

While it is true that there are some additional risks involved with international investing—currency risk and geopolitical event risk being top-of-mind for many—it is also the case that there are a number of opportunities presented to ordinary investors by owning international securities. In this article, we’re going to try to de-mystify the idea of international securities and look at some reasons why investors might want to consider expanding their holdings to include a more global concept.

Shopping in “the Whole Store”

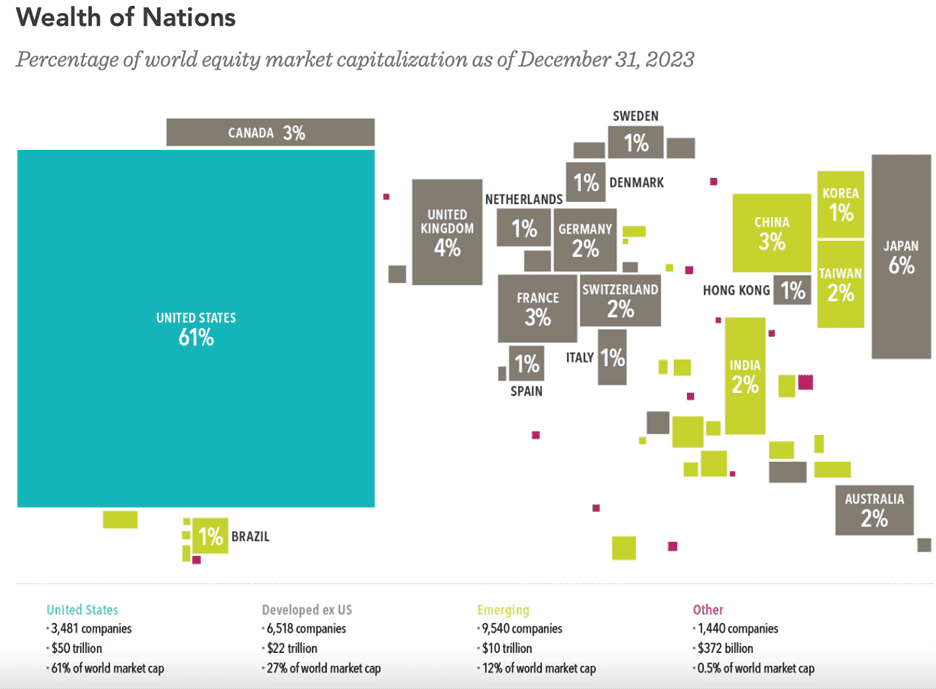

As mentioned, while the US is the world’s largest financial market by capitalization, we should also remember that US markets make up only 60% of the world’s opportunities for equity investing. Consider the following chart:

SOURCE: Dimensional Fund Advisors; indexes are not available for direct investment.

Though the US equities markets are the “big kid,” the shares of some 17,500 companies trade outside US borders. These include globally recognized names such as Unilever, Shell Oil, and Deutsche Bank, along with many others. There are also thousands of smaller corporations with solid revenue and growth characteristics that those who limit themselves to US equities may never have the opportunity to own.

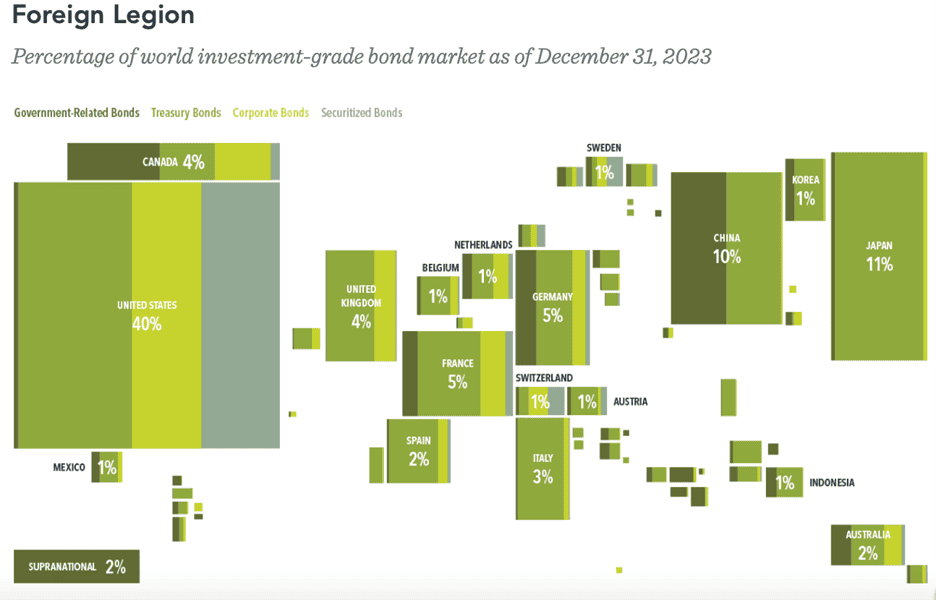

And it’s not just equities. While the US dollar continues to be the world’s preferred reserve currency, the US fixed-income market cannot claim to represent the majority of the world’s investment-grade debt, as the following chart indicates:

SOURCE: Dimensional Fund Advisors; indexes not available for direct investment.

So, considering both fixed-income and equity-based investing, we can conclude that a significant body of opportunity exists outside the borders of the US. When investors are willing to look outside the US, they can capture equity returns from thousands of companies around the globe and potentially offset weak performance in one market with stronger returns elsewhere. Returns in 2022 offer a useful example of this phenomenon: The US stock market tumbled 19.8%, but non-US developed markets like the UK (–4.8%) and Hong Kong (–4.7%) performed much better. 1 And, in two examples from emerging markets, Turkey soared 90.4% and Chile gained 19.4%. Similarly, in fixed income markets, both yields and total returns typically vary across the globe and often do not move in lockstep, which is no surprise. Bonds issued in different countries and currencies can offer a range of yields and expected returns.

It is also the case that a country’s size, population, or gross domestic product doesn’t necessarily tell us much about the investment opportunities in that country. Japan, for instance, is relatively small in landmass but accounts for 6% of the world’s equity market value—representing over 2,500 companies, including familiar names like Toyota and Sony—as well as 11% of the investment-grade bond market. Even a tiny country like Switzerland is home to publicly traded giants like Nestlé and two of the world’s biggest pharmaceutical firms. And here’s an interesting fact: In 2023, 121 countries ranked ahead of the U.S. for GDP real growth rate, according to the US Central Intelligence Agency’s World Fact Book, compiled in January 2025.

By looking outside their home market, investors can expand their choices and opportunities for higher expected returns. A global approach can also enhance diversification, which may help reduce portfolio risk and volatility. This isn’t guaranteed to produce strong returns every year, but it can deliver more reliable outcomes over time, helping investors stay on track toward achieving their long-term goals.

How to Choose?

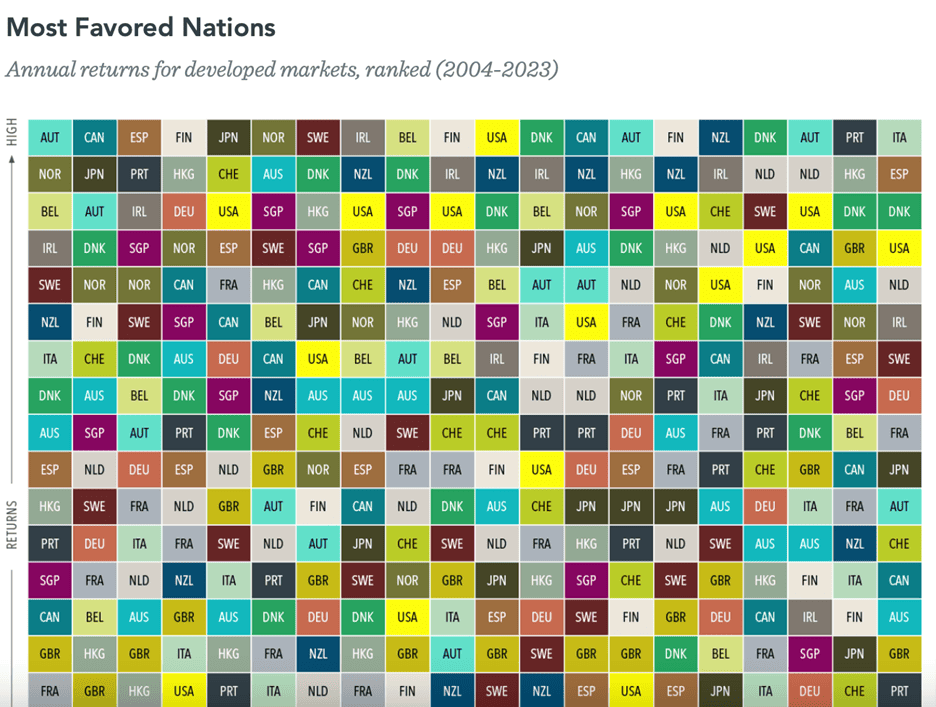

If all this is new to you, you might be wondering, “How am I supposed to know which countries’ markets will be the strongest in any given year?” The answer, of course, is that you can’t be expected to predict the short-term direction or return of any market or even group of markets. Consider the following graphic, noting that the top entry in each column was the highest-performing market for that year; the chart covers the years 2004–2023:

SOURCE: Dimensional Fund Advisors; past performance is no guarantee of future results; indexes are not available for direct investment.

Looking at this chart of the 16 highest-performing equity markets, 2004–2023, reveals that US markets topped the list in just 1 of the twenty years shown. It might be surprising for many investors to learn, for example, that the 26.29% return of the S&P 500 in 2023 would have landed it roughly in fourth place for that year. Italy, with a return of 38.8%, captured the honors for that particular year.

As you can see, the patterns of “best to worst” for any given year are pretty random, which is the case for all financial markets. But the investor who intends to capture expected returns over a diversified range of assets, rather than trying to pick the “right” country or asset type, might instead invest in a diversified group of international securities, realizing that the “winner” in any given year may not perform as well the following period. Over time, however, diversification might allow the investor to realize expected performance.

It is not necessary to hold foreign securities in their native currencies. US investors have the convenience of access to US dollar–denominated mutual funds that invest in various international assets, and individual foreign securities may even be held in the form of American Depository Receipts (ADRs), which are denominated in US dollars.

At JFS Wealth Advisors, we know that our clients are looking for better ways to mitigate risk while positioning themselves for expected returns in various asset classes. Diversification is one of the investor’s greatest tools for mitigating risk, and modest exposure to international assets may enable investors to achieve broader diversification than limiting themselves to domestic assets only. If you would like to know more about global investing could benefit you, please talk to us; we’re here to answer your questions.

Sources: