We hope you have had a restful break over the holidays and have been able to spend time with family and friends. As we enter 2022, we write to offer some observations on one of the main topics we encounter in our meetings and conversations with clients – inflation.

It seems nearly impossible to read or listen to the news today without hearing about rising inflation. Simply head to the grocery store, gas station, or heaven forbid, shop for a new car, and we run headlong into its impact. For many, this is a first-time event, with the last serious bout of inflation coming in the late 1970s.

Paul Volcker, Fed Chair at that time, staked his career and the economic well-being of the U.S. on an aggressive strategy of rate hikes to combat the rapidly rising spiral of prices. While painful and the cause of a difficult recession, the medicine was successful, and following a peak in 1981, interest rates and inflation fell and have generally stayed low in the intervening years. Until now that is, leading many to question if we are in for a repeat of those hard times when the phrase “stagflation” was coined, shorthand for a stagnant economy but high inflation.

In periods of inflation, rising prices often lead to an increase in consumption. Demand goes up because consumers fear that prices will be even higher in the future, and/or their currency will be worth less than today. While economic activity rises, “real” measures (after subtracting inflation) may be stagnant or falling. Assets not able to adjust to overall rising price levels may lose real value as their future cash flows are eroded. This is the classic example for securities with set income streams, as well as those individuals relying on a fixed source of income – while income may stay level, their purchasing power is steadily eroded.

While the effects may be similar, the causes of inflation can vary. The current bout is directly tied to the extraordinary and unique effects of the pandemic, and the resultant problems caused by supply chain issues and labor shortages colliding with a rapid rise in demand as global economies slowly begin to revive. From lumber to food to energy, prices have increased, and there are signs that the pressures are spilling into wages – a step that can prove far “stickier” than a brief shortage of a good. So, does this mean we are in for painful rate hikes and a recession as happened in the ‘80s?

It seems unlikely – at least at the moment. The current Fed Chair, Jerome Powell, has led the Open Market Committee to begin an aggressive wind-down of their bond purchases, a move that directly removes liquidity from financial markets and causes upward pressure on rates. In addition, the Fed has telegraphed that once these purchases are halted – likely in Q1 or Q2 2022 – hikes in interest rates are anticipated to follow.

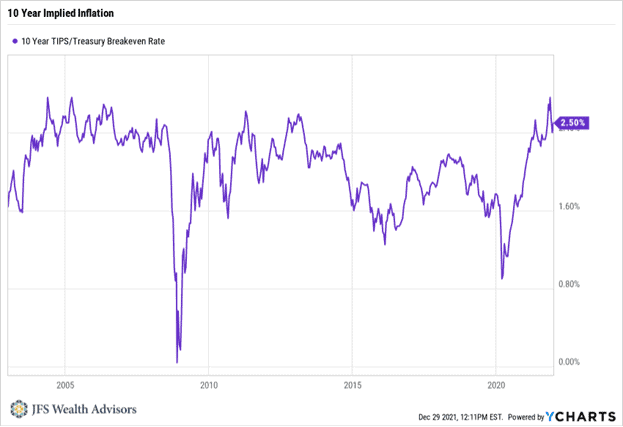

And this trend is not just contained to the U.S. The Bank of England hiked rates in mid-December, and countries from Norway to Brazil to South Korea raised rates even before then. In other words, while some argue that hikes should have come sooner, global central banks are not asleep at the wheel. Markets currently forecast that while inflation pressures will not disappear overnight, they will level off. At this writing, breakeven rates (the bond market-implied rate of future inflation), sit at 2.7% in 5 years and fall to 2.50% in 10 (see chart below).

These first steps toward removing excess liquidity from the system seem likely to be the beginning of a post-pandemic move on the way to a new rate equilibrium. Recall that following the 2008 Great Financial Crisis, the Federal Reserve, for the first time in history, pushed its Fed funds target to zero. As the world very slowly recovered, short-term Fed rates began a gradual climb toward normalcy – hitting 2.43% in 2019 – before plunging again to zero in 2020 when the pandemic swept the world. Re-establishing a more historical level of rates is something we should welcome, as it would indicate that world economies no longer need massive stimulus efforts to stay afloat, and would also bring some welcome increases to those reliant on fixed sources of income.

Of course, the current fear of unwelcome inflation as those rates move up is a valid concern. While it’s critical to portfolio health not to overreact when shepherding long-term assets, that does not mean there are no antidotes to inflation. Let’s look at some of the steps that can help protect your portfolios and purchasing power.

Stocks

Common stocks have outpaced inflation over their history, making them the best long-term choice, but over shorter periods of time, they are not always an effective hedge. While stable companies can innovate and increase earnings, dividends, and profit margins over time (keeping pace with or exceeding inflation), in the short run, stocks may offer little protection against inflation spikes because short-term equity returns are driven more by sentiment, corporate, and economic fundamentals.

Also, various stocks and sectors react differently. For example, some companies have a greater ability to pass price increases through to consumers than others (think recent increase in gas prices or your grocery bill). Utility companies are generally locked in on rates they can charge and can only adjust with the approval of their local utility commission. So, for example, owning dividend-paying utility companies, while attractive for an income stream, will likely disappoint from a price perspective during rising inflation.

Using well-established academic research as a guide, JFS equity portfolios typically emphasize factors that are embedded in stock price information, enabling us to target characteristics that, over time, can result in returns in excess of benchmarks. By favoring value stocks, whose earnings are generally less sensitive to rate rises, and by casting a global net for attractive opportunities, we seek to build portfolios that can bring added value to the table for clients and should be well-positioned as we enter 2022.

Real Estate

Traditionally, real estate has also proven to be an effective hedge against inflation, but it is important to cast a broad net. Many people “anchor” their view of real estate solely to the residential housing market. But REITs, or real estate investment trusts, can offer diversified exposure to the real estate market and include healthy sectors such as commercial real estate in storage and warehouse facilities, recession-resistant areas such as healthcare, grocery, and staples, lodging like hotels and apartments, and even office space (which in many areas still is quite solid). REITs are required by tax law to pay out 90% of their net earnings, and thus generally pay attractive dividends, which can grow with inflation and similarly act as a cushion against any price volatility.

Alternative Investments

As trading costs have fallen dramatically in recent years, there are increased opportunities for investors to explore areas that were once the exclusive domain of large Wall Street firms. Mutual fund families have developed funds that offer global exposure to non-traditional asset classes such as commodities, currencies, and interest rates that can otherwise be difficult for investors to pursue on their own. Like anything, if it sounds too good to be true it almost certainly is, but research and careful selection can provide some attractive non-correlated funds that can be a solid portfolio offset to traditional bonds and stocks.

Bonds

Reading some of the headlines out there might lead you to believe owning bonds is foolhardy. Yet that simplistic viewpoint badly misses the mark. As mentioned previously, while bonds do have a more predictable – inverse – relationship with inflation, meaning that prices typically sink when inflation and rates are rising, they remain an important tool in portfolio construction.

High-quality bonds such as government, agency, and those issued by strong corporations can act as an offset to stock price volatility – literally buffering portfolios when stock prices sink. And if thoughtfully managed by keeping interest rate exposure to the short or intermediate portion of the yield curve, the rising income stream generated by reinvesting bond fund dividends can offset any small price decline if patiently held.

In conjunction with your specific goals, JFS advisors can target portfolio exposure to certain bond sectors such as inflation-protected treasuries or foreign bonds, that can offer even more diversification and shelter from U.S. inflation. Like most investment issues, it requires a nuanced approach to make work best for each individual – one-size-fits-all statements or solutions are not very successful.

As the chart below shows, U.S. stocks as tracked by the S&P 500 have been a clear winner over inflation for the past 25 years, as have investment-grade bonds, as represented by the Barclays Aggregate Index. Of course, if inflation were to charge ahead at the current pace the picture could change, but that seems unlikely.

Plotting a Course with Your Advisor

As we indicated in our opening comments, rising inflation and interest rates are at the forefront of many conversations. We think it prudent to closely watch and take intelligent steps to counter these pressures – but not to follow a knee-jerk reaction and overload one particular stock sector or avoid the bond market in its entirety.

Even in rising rate environments, bonds bring many attributes to the table of portfolio management. Many who thought rates were certain to move in one direction or another have repeatedly been proven wrong. Successful investing is not about blindly chasing a “sure thing” or even the highest possible return – that inevitably leads to correspondingly painful swings and misses, and uncomfortable or outright frightening drops in value leading to fear-driven poor decisions. Rather, successful investing blends the knowledge of long-term market facts with the unique circumstances of the moment to prudently build resilient portfolios.

New Year discussions are a great time to not only review with your JFS advisor the potential impact of inflation on your portfolio but to also update your planning and current and future needs, allowing us to always have your wealth management synchronized with your goals and objectives.

From all of us at JFS – we wish you a happy, healthy, and prosperous New Year.