Q3 2023: A Tale of Two Economies?

As we reach the final three months of 2023, predictions, and assumptions about the future direction of Fed policy continue to dominate US financial markets. And, while the U.S. central bank’s program of interest rate hikes, pursued since March 2022, has apparently produced significant progress in cooling the runaway inflation of 2022, its effect on the nation’s economy continues to manifest in contrasting ways, depending on which sector of the economy is under consideration.

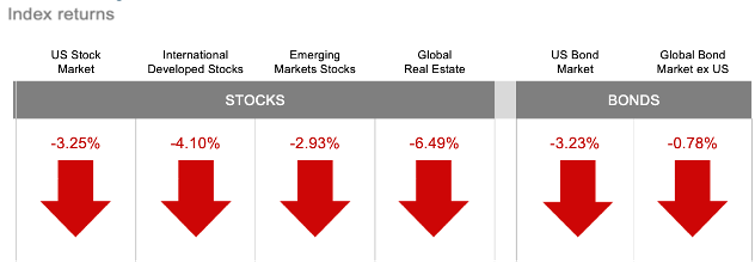

The third quarter of 2023 saw both stock and bond prices fall, as fears over persistently high interest rates returned in force. For the quarter, the broad U.S. stock market as measured by the Russell 3000 index declined 3.25%, the S&P 500 was down 3.65%, and small US companies as measured by the Russell 2000 fell by 5.49%. International developed markets dropped 4.1%, and emerging markets sank 2.93%. The U.S. bond market measure, Bloomberg Barclays Aggregate, also gave up ground, declining 3.23% as interest rates rose.

Unemployment remains at a low 3.8%, which, coupled with robust consumer support, has kept pressure on the Federal Reserve to remain vigilant on inflation. After raising rates 0.25% in July, the FOMC held the Fed Funds rate steady at 5.25% – 5.5% in September, indicating that while another quarter-point hike could be in the cards before year-end, they are inclined to pause while observing additional data. Inflation remains a key focus, and while it is clearly cooling as supply chains have mostly healed following the pandemic disruptions, high energy and food costs remain problematic. August’s CPI level was an encouraging 3.7% annual rate of inflation (versus a reading of 8.3% at the same time the prior year), but a 10.6% jump in gasoline prices for the month kept consumers feeling the pinch; even with a strong rate of employment, purchasing power is diminished. Surveys indicate that while many Americans are confident in their employment, inflation in the price of goods has kept them unsettled and dissatisfied with their reduced spending power.

Rate pressures remain firmly in place. The 10-year U.S. Treasury bond ended the quarter at 4.57%, up over ¾ of a percent, and many analysts are indicating 5% is not out of reach (when bond yields rise, bond prices fall). Contributing to the rise, crude oil prices skyrocketed nearly 29%, ending the quarter at $90.87. (As we write this, a new Israeli/Palestinian conflict has erupted with tragic results, likely adding more upward price pressure to crude oil). The price of gold fell again, ending the quarter at $1,864.90.

At JFS Wealth Advisors, our central focus is providing our clients with the information and guidance they need to make informed decisions. Visit our Knowledge Center to learn more about the latest trends and topics, including our latest article, “Stubbornly Persistent Interest Rates.”