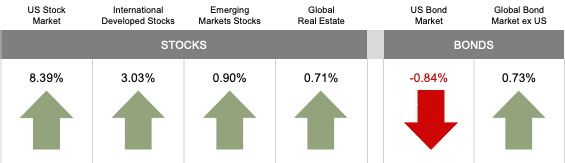

The second quarter of 2023 saw stock and bond returns diverge as concerns over inflation and a potential recession were overcome by excitement (some would say, hype) about the blossoming field of artificial intelligence (AI). For the quarter, the broad U.S. stock market, led by a handful of technology companies, gained 8.4%, and small US companies as measured by the Russell 2000 climbed 4.8%. International developed markets rose 3.0%, and emerging markets were up 0.9%. Clear messaging from the Federal Reserve (Fed) that their rate hiking program, while paused in June, was not yet over, reined in bond returns, with the Bloomberg US Aggregate Index falling 0.8%.

US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net dividends]), Emerging Markets (MSCI Emerging Markets Index [net dividends]), Global Real Estate (S&P Global REIT Index [net dividends]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global.

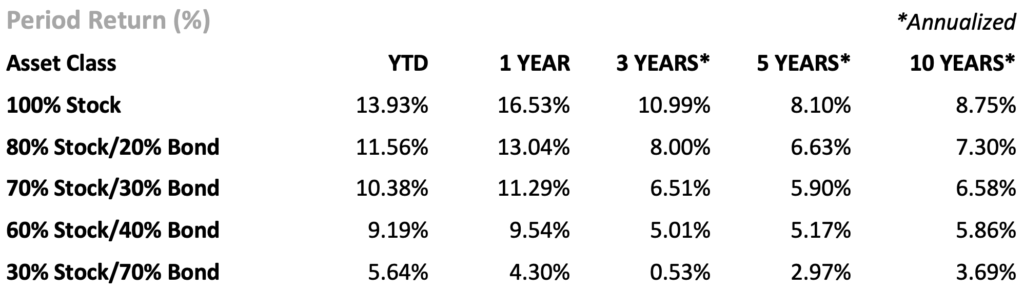

Indices used for hypothetical portfolios returns are the MSCI ACWI for equities and the BBgBarc US Agg Bond for fixed income. All data derived from Morningstar Office. Past performance is no guarantee of future returns.

U.S. economic data for the quarter has been often contradictory, leading to significant differences in forecasts. Backing up their argument for a coming recession, some point to the ISM manufacturing index in June, which measured a gloomy 46 (below 50 indicated declining output), its 8th straight month of contraction. And the yield curve remains inverted – a generally reliable indicator meaning short-term rates are higher than longer rates, suggesting a belief that rates will fall in the future as the economy cools.

On the positive side of forecasts, 209,000 new jobs were created in June, and the unemployment rate is a low 3.6%. The services ISM index is at 53.9, indicating growth, as solid employment and wages lead to consumer spending. The strongest service areas in June were Accommodation and Food, followed by Arts and Entertainment and recreation. In other words, the consumer is spending the money in their pockets. Globally the same dichotomy is being seen — J.P. Morgan’s Global PMI, while still positive at 52.7, fell to a four-month low on weak manufacturing output.

At their June meeting the Federal Open Market Committee maintained the Fed Funds rate at 5.0% – 5.25%. This marks the first time since March 2022 that the Fed has not increased rates at a meeting. Market projections anticipate an additional 0.50% of increases by the end of 2023, with another hike deemed likely as soon as their July 25–26 gathering. June’s inflation report delivered further proof that inflation is easing, a positive sign for the economy and markets. CPI rose 0.2% in June, and is up 3% year-over-year, a decisive cooling from the 9.1% rate just a year ago. The Fed has a target inflation rate of 2% — and the five-year inflation expectation indicated by TIPS is at 2.2% — a signal that markets believe inflation is back under control.

The 10-year U.S. Treasury bond ended the quarter at 3.81% and has flirted with the 4% level since. Crude oil has been volatile, as OPEC + has announced production cuts. But compliance with the lowered targets is spotty, and for the quarter, crude declined by roughly 7%, ending at $70.47/bbl. This has led to welcome relief at the pump; the average gas price for the week of June 26 was $3.55/gallon, down nearly 30% from the level of $4.87 a year ago. Gold prices fell by 3.1% for the quarter, primarily pushed down by a stronger dollar, and ended the quarter at $1,926 per ounce.